Reinvesting in a Rising Market is Like Merging into Traffic... It’s Best to Have a Plan

Getting Out of the Market is Easy... Getting Back in can be Another Matter Entirely

Investors are regularly inundated with scary headlines and dour forecasts that provide ample reasons to get out of the stock market. COVID-19 has been just that kind of catalyst. Combine that with a human’s natural ‘fight or flight’ instincts that kick-in when markets are volatile, and it is not unusual to find oneself holding too much cash after a big sell-off. Unfortunately, we believe few that find themselves in this position know what to do or have a plan for reinvestment. This week’s edition of the Weekly View is dedicated to the age-old question: ‘What do I do when I have too much cash on the sidelines?’

FIRST: SWALLOW YOUR PRIDE

It is easy to celebrate successes; we believe that the best investors are those who know how to manage their mistakes. No one likes to admit that that they bought or sold for the wrong reasons, or that their hopes or worries were misguided. Many would prefer to stick with their decisions, even when the preponderance of evidence suggests otherwise. We believe investors need to get comfortable with the notion of ‘being wrong’ and moving on. If you sold stocks and the market did not go down, don’t beat yourself up over it. It is important not to compound a bad decision by failing to recognize when the facts change. In our view, ‘being wrong’ happens to all investors from time to time, but ‘staying wrong’ often makes the difference between investment success and failure.

SECOND: DETERMINE WHETHER THE CONDITIONS HAVE CHANGED

If you sold stocks in 2020 because of COVID-19, it is important to recognize that the market will likely bottom well before macro-economic conditions improve. While no one can say for certain when the crisis will be behind us, we do recognize that a significant amount of ‘bad news’ may already be discounted into stock prices and an unprecedented amount of monetary and fiscal stimulus has already been implemented. For example, the Federal Reserve has lowered the Fed Funds Target Rate to 0%, restarted quantitative easing, and implemented large lending facilities to support market functioning. Congress has also passed the Coronavirus Aid, Relief, and Economic Security Act (CARES), which is the largest fiscal stimulus program in US history valued at $2.2 trillion. Monetary and fiscal policymakers across the globe have also enacted similar stimulus programs. According to Evercore ISI, nearly 300 stimulus measures have been announced in the past month around the world.

THIRD: DETERMINE IF CASH UNDERMINES LONG-TERM GOALS

In today’s low interest rate environment, large cash holdings could be an obstacle to funding future obligations, such as college or retirement. There is also a chance that long-term inflation rates rise with increased quantitative easing (QE) and generous fiscal stimulus programs; ultimately eroding purchasing power. When cash is accumulating to a reasonable level of interest in the bank or in a brokerage account, the long-term costs of sitting out can be less punitive. However, with short-term rates below inflation, cash on the sidelines provides negative real returns as it sits idle. If one needs their portfolio to grow, less risk-taking today could lead to greater risk taking tomorrow.

FOURTH: DON’T BE ‘PENNY-WISE AND POUND-FOOLISH’

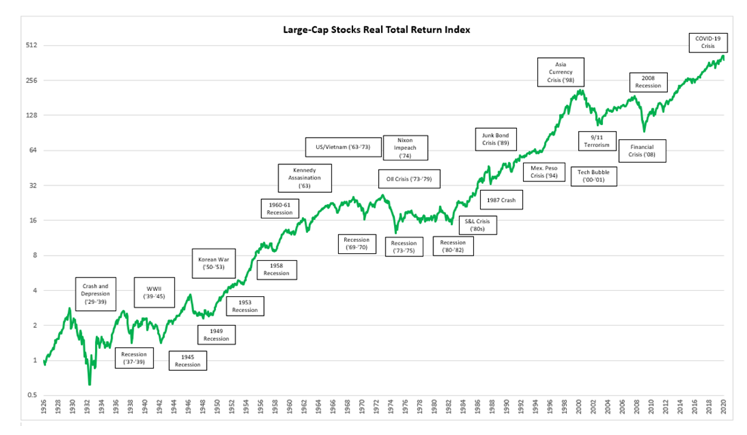

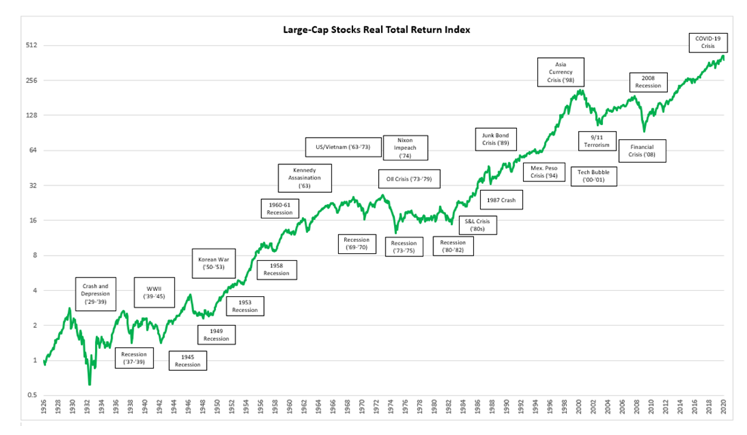

In our view, the longer an investor’s time horizon, the less important market entry points are. We believe the adage that successful investing is about ‘time in the market,’ NOT ‘timing the market’ holds merit for long-term investors for two reasons. First, over long-time horizons, the US stock market generally recovers its losses and continues to climb the ‘Wall of Worry’ (chart below).

Source: IFR, Wikipedia, RiverFront, CRSP, Data updated through February 2020. Shown for illustrative purposes and not intended as an investment recommendation. Not indicative of RiverFront portfolio performance. Past performance is no guarantee of future results.

Second, long-term investors benefit from a powerful force: compound interest. Compound interest allows a $100 investment growing at 10% annually to return more than 6 times an investor’s initial money after 20 years. We believe that investors who jump in and out of the market with significant amounts of their portfolios tend to be un-invested or underinvested more frequently and thus less likely to experience the full benefits of market recoveries or compound growth.

FIFTH: DEVELOP AND EXECUTE ON A PLAN

Second, long-term investors benefit from a powerful force: compound interest. Compound interest allows a $100 investment growing at 10% annually to return more than 6 times an investor’s initial money after 20 years. We believe that investors who jump in and out of the market with significant amounts of their portfolios tend to be un-invested or underinvested more frequently and thus less likely to experience the full benefits of market recoveries or compound growth.

This is a critical part of our process at RiverFront. There are many reinvestment strategies that have shown historical efficacy. We believe that entry and exit strategies should be consistent with the investor’s goals and objectives and not solely dependent on one’s ability to accurately forecast market movements over short periods of time. Thus, when you deviate from your long-term goals, we think it is critical to have a plan for how you are going to return to them.

A REINVESTMENT PLAN: MERGING INTO TRAFFIC

Reinvesting into a market that could be rising can be similar to an activity that we are all familiar with: merging into moving traffic. For most of us, the action of merging requires little thought because it has become second nature. However, if we take a minute to examine it, we can identify three important steps that can be applied to the reinvestment process.

Get Started: When you are merging onto the interstate you start the process immediately by getting up to speed. You don’t stop on the entrance ramp to wait for an opening because if you did you would lose all of your momentum (and your nerve). Likewise, when reinvesting cash, we believe investors should also start the process sooner rather than later. We believe that stocks will generally be higher than current levels 12-18 months from now. Therefore, we recommend that long-term investors with time horizons greater than 5 years, begin putting some of their excess cash to work as soon as possible. In the current market sell-off, we are concerned about slower earnings growth in the quarters ahead, but we believe that the market will likely look through those earnings once there are increasing signs that the world is getting COVID-19 under control.

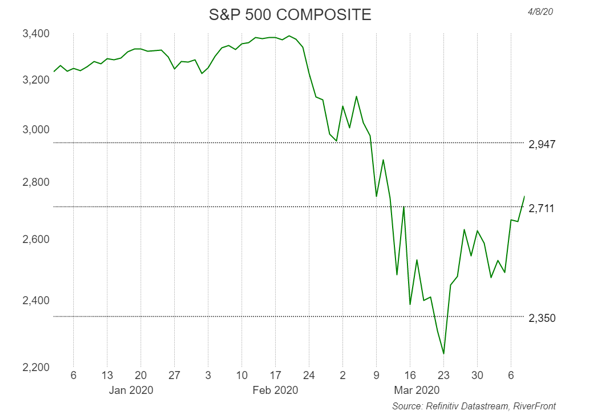

Shown for illustrative purposes. Not indicative of RiverFront portfolio performance. Past performance is no guarantee of future results.

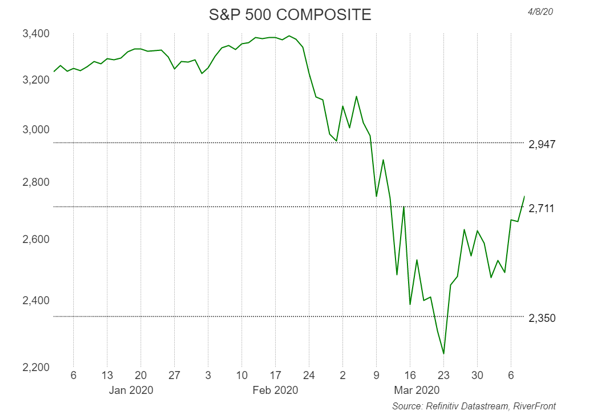

- PORTFOLIO IMPLICATIONS: Reinvest some Opportunistically: When merging onto the highway, gaps in the traffic will appear as you get up to speed. These gaps provide opportunities to merge more quickly. From a reinvestment perspective, investors can designate a portion of their cash to take advantage of opportunities that may arise as a result of market volatility. In fact, after more than a 20% bounce from the March 2020 lows, it would be surprising if we did not experience some pullback or digestion period in coming months. Should that occur, some investors may want to accelerate their purchases, taking advantage of that weakness. Even so, at or around the 2350 level on the S&P 500 might be an attractive opportunistic entry point. Others may want greater evidence that the COVID-19 crisis is behind us and therefore prefer to be opportunistic ‘on strength.’ We believe that the market may be putting virus fears behind it if the S&P 500 holds and eclipses important resistance levels like 2711 and 2947.

- Complete Gradually: Gradually the merger lane comes to an end, and the driver must complete the merge. Reinvestment windows also come to an end because investors risk missing out on the ‘power of compound interest’ if they fail to reinvest in a timely manner. To offset the risk of bad timing, investors can use a dollar-cost- average approach to gradually reinvest on a series of dates over a defined time period. Three to six months is probably the appropriate time period for a long-term investor to complete their cash reinvestment period, in our view.

RiverFront’s balanced portfolios are currently positioned slightly defensively as the portfolio’s equity weightings are 3-6% below their composite benchmarks. Our portfolio management teams continue to monitor COVID-19 developments and meet regularly to construct and implement de-risking and re-risking plans.

Source: https://www.riverfrontig.com/resources/commentaries/single/weekly-view-reinvesting-rising-market-merging-trafficits-best-have-plan/

Important Disclosure Information

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Past results are no guarantee of future results and no representation is made that a client will or is likely to achieve positive returns, avoid losses, or experience returns similar to those shown or experienced in the past.

Information or data shown or used in this material is for illustrative purposes only and was received from sources believed to be reliable, but accuracy is not guaranteed.

In a rising interest rate environment, the value of fixed-income securities generally declines.

When referring to being “overweight” or “underweight” relative to a market or asset class, RiverFront is referring to our current portfolios’ weightings compared to the composite benchmarks for each portfolio. Asset class weighting discussion refers to our Advantage portfolios. For more information on our other portfolios, please visit or contact your Financial Advisor.

Investing in foreign companies poses additional risks since political and economic events unique to a country or region may affect those markets and their issuers. In addition to such general international risks, the portfolio may also be exposed to currency fluctuation risks and emerging markets risks as described further below.

Changes in the value of foreign currencies compared to the U.S. dollar may affect (positively or negatively) the value of the portfolio’s investments. Such currency movements may occur separately from, and/or in response to, events that do not otherwise affect the value of the security in the issuer’s home country. Also, the value of the portfolio may be influenced by currency exchange control regulations. The currencies of emerging market countries may experience significant declines against the U.S. dollar, and devaluation may occur subsequent to investments in these currencies by the portfolio.

Foreign investments, especially investments in emerging markets, can be riskier and more volatile than investments in the U.S. and are considered speculative and subject to heightened risks in addition to the general risks of investing in non-U.S. securities. Also, inflation and rapid fluctuations in inflation rates have had, and may continue to have, negative effects on the economies and securities markets of certain emerging market countries.

Stocks represent partial ownership of a corporation. If the corporation does well, its value increases, and investors share in the appreciation. However, if it goes bankrupt, or performs poorly, investors can lose their entire initial investment (i.e., the stock price can go to zero). Bonds represent a loan made by an investor to a corporation or government. As such, the investor gets a guaranteed interest rate for a specific period of time and expects to get their original investment back at the end of that time period, along with the interest earned. Investment risk is repayment of the principal (amount invested). In the event of a bankruptcy or other corporate disruption, bonds are senior to stocks. Investors should be aware of these differences prior to investing.

You cannot invest directly in an index.

Standard & Poor’s (S&P) 500 Index measures the performance of 500 large cap stocks, which together represent about 80% of the total US equities market.

Market Cap index information calculated based on data from CRSP 1925 US Indices Database ©2016 Center for Research in Security Prices (CRSP®), Booth School of Business, The University of Chicago.

Used as a source for cap-based portfolio research appearing in publications, and by practitioners for benchmarking, the CRSP Cap-Based Portfolio Indices Product data tracks micro, small, mid- and large-cap stocks on monthly and quarterly frequencies. This product is used to track and analyze performance differentials between size-relative portfolios.

ranks all NYSE companies by market capitalization and divides them into ten equally populated portfolios. Alternext and NASDAQ stocks are then placed into the deciles determined by the NYSE breakpoints, based on market capitalization. The series of 10 indices are identified as CRSP 1 through CRSP 10, where CRSP 10 has the largest population and smallest market-capitalization. CRSP portfolios 1-2 represent large cap stocks, portfolios 3-5 represent mid-caps and portfolios 6-10 represent small caps.

Investment Group, LLC (“RiverFront”), is a registered investment adviser with the Securities and Exchange Commission. Registration as an investment adviser does not imply any level of skill or expertise. Any discussion of specific securities is provided for informational purposes only and should not be deemed as investment advice or a recommendation to buy or sell any individual security mentioned. RiverFront is affiliated with Robert W. Baird & Co. Incorporated (“Baird”), member FINRA/SIPC, from its minority ownership interest in RiverFront. RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated, a registered broker/dealer and investment adviser.

To review other risks and more information about RiverFront, please visit the website at www.riverfrontig.com and the Form ADV, Part 2A. Copyright ©2020 RiverFront Investment Group. All Rights Reserved. ID 1149365

Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website’s users and/or members. Raymond James does not provide tax or legal services. Please discuss these matters with the appropriate professional.