Archive for the ‘Newsletter’ Category

CrossleyShear Wealth Management's Media

Sustainability’s Imprint on the Business World

Sustainability’s Imprint on the Business World

Sustainability’s Imprint on the Business World

As investors and consumers seek sustainability, companies transform their approach to solving some of the world’s biggest challenges.

Big-box stores bumping up wages. Plastic straws and mini shampoo bottles going the way of the dodo. Shoes and shirts fashioned from recycled bottles. Welcome to the new normal, where sustainability is increasingly woven into your everyday life.

Behind the small changes you see is a big shift in how companies are tackling environmental, social and governance (ESG) issues – everything from working conditions and energy efficiency to data security and business ethics – as money managers factor sustainability into investing.

“Investors want business leaders to focus on ESG … [it] isn’t just a nice-to-have anymore,” Oxford University professor and sustainability scholar Robert Eccles told Harvard Business Review. “It’s something shareholders will demand, because they believe it’s going to drive everything else they care about: growth, market share, profitability.”

Demand is the right word. This year some of the world’s largest asset managers have called sustainability the “new standard” for investing. Governments and consumers are getting on board as well. For example, the European Union now requires that corporations disclose how they manage social and environmental challenges. And at supermarkets and stores in the U.S., sustainable products have accounted for 50% of the growth in packaged goods.

So, how are corporations shaping the future? Raymond James Equity Research analysts across industries offered their insights into how an increased focus on ESG issues is driving change.

Data as the common thread

One common theme that spans from food producers to big-box retailers is the innovation fueled by data accessibility and transparency. This empowers farmers to reduce food loss and waste, enables retailers to use RFID chips to help recycle and resell clothing, and helps airlines optimize efficiency and reduce their carbon footprint. Companies are also gaining more transparency into their supply chains as they seek to measure – and mitigate – ESG risks and avoid any link to issues such as forced labor, unregulated deforestation and other practices with negative social and environmental impacts.

While big data represents opportunity, it’s also a big challenge: What ESG metrics should industries report on? Which ones are so closely tied to company performance that they can’t be ignored? After all, hazardous waste disposal may pose a significant ESG risk for a chemicals company, but not a professional services firm.

To answer those questions, the Sustainability Accounting Standards Board in 2018 published voluntary guidelines mapping material ESG issues to 11 sectors. This recent shift to pinpoint ESG factors that could hamper growth or increase costs for a particular industry is a crucial one, experts say, because it promises more relevant information and greater insight into the risks and opportunities companies are facing.

Powered by clean tech

Another sustainability theme is the adoption of renewable energy across industries. This is happening as costs for wind and solar have plummeted and technologies improve. Examples include data centers pledging to go “carbon negative” with wind and solar, and “green” buildings becoming mainstream.

We are still awaiting breakthroughs in clean battery technology that would allow us to power everything from air conditioners to airplanes when the wind doesn’t blow and the sun doesn’t shine. But even electric aviation, an idea that once seemed out of reach, is closer than you might think. Eviation’s electric prototype plane, unveiled in 2019 with an 8,200-pound battery and a range of 650 miles, is proof of that.

A shift toward “enduring value”

As companies embrace sustainability, many investors have stopped viewing it as a niche strategy.

Strikingly, 26% of all U.S. professionally managed assets, nearly $12 trillion, are already classified as sustainable, and that number is rising. ESG-aligned mutual funds and ETFs available to U.S. investors raked in $20.6 billion of total new assets in 2019, data provider Morningstar reported, four times the $5.5 billion captured in 2018. Worldwide, these assets more than doubled from 2012 to 2018, surpassing $30 trillion.

These are the kind of eye-popping numbers behind a global movement. Though barriers related to ESG information and measurement persist, the desire to focus on the long term seems here to stay.

As a 2020 report from consulting firm KPMG plainly states, “Sustainable investing is about creating businesses of enduring value” – something most anyone can appreciate.

Learn more about how industries are making future-minded progress at RaymondJames.com/PoweringForward.

Sources: Raymond James Equity Research, EU's Non-Financial Reporting Directive of 2018; NYU Stern’s Center for Sustainable Business; Harvard Business Review; Morningstar; Lazard’s 2018 Levelized Cost of Energy report

Investing involves risk and you may incur a profit or loss regardless of the strategy selected. Sustainable investing considers qualitative environmental, social and corporate governance, also known as ESG criteria, which may be subjective in nature. As with any investment, there is no guarantee that sustainable investing products or strategies will produce positive returns. Investors should consult their investment professional prior to making an investment decision.

Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website’s users and/or members. Raymond James does not provide tax or legal services. Please discuss these matters with the appropriate professional.

Tips for Creating an Inheritance That Lasts Generations

Tips for Creating an Inheritance That Lasts Generations Option

Preparing your heirs for sudden wealth can help prevent unwise spending.

If you have wealth to transfer, you may worry about the sometimes adverse effect of sudden wealth and the squandering of assets within a generation.

There is a good reason to be concerned: 70% of family money disappears by the second generation, and 90% by the third generation, according to the Williams Group wealth consultancy. The cautionary tales of families like the Vanderbilts also feed into this worry.

The result? Around 60% of parents think their children aren’t prepared to receive a large inheritance, a study by U.S. Trust shows.

If you’re in this position, you have a number of options to help ensure your legacy lasts.

Consider taking advantage of a trust

Trusts can help eliminate some of the guessing game of where money might end up, while allowing you to dictate how and when your assets are distributed after you die.

For individuals with relatively young heirs, age provisions that dole out trust income to beneficiaries only when they’ve reached certain ages can be beneficial. A common threshold for distribution is reaching age 25 or 30. Generation-skipping trusts are another helpful vehicle. In some cases, this type of trust can allow you to transfer money tax-free to your grandchildren or great-grandchildren.

Connect through philanthropy

Making charitable giving a family affair can provide opportunities to connect with younger generations and communicate values and ideals. When a philanthropic mission is shared among your family, it provides a forum for communication and sharpened decision-making in a situation where the money is going to others and there is no personal interest at stake. Donor advised funds and private foundations can be effective vehicles for this type of endeavor. Charitable remainder trusts (CRTs) can also help if you wish to give assets to charity in order to leave a smaller inheritance.

Talk to your heirs about your vision

Many squandered inheritances can be traced back to a root cause – poor communication. In nearly 60% of boom-and-bust inheritance cases researched by the Williams Group, trust and communication breakdown among family members played the largest role.

To help prevent a communication breakdown, consider sharing history, values and a vision for the future of your family. This can be done in person at a family gathering or through a written statement, also known as an ethical will or legacy letter. With a common purpose and shared story, your family stands a better chance of preserving assets for future generations.

Leverage a professional’s perspective

The Williams Group research points to failure to properly prepare heirs as another cause of lost inheritance, affecting about 25% of the cases studied. Your financial advisor can play a role in educating you and your family about inheritance, as well as wealth management and its important principles.

Creating a lasting legacy is neither easy nor impossible – the difficulty lies in the details. Finding the tools and resources that will benefit your family and situation can help make the difference between a squandered fortune and an inheritance that lasts generations.

Raymond James is not affiliated with the Williams Group.

Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website’s users and/or members. Raymond James does not provide tax or legal services. Please discuss these matters with the appropriate professional.

Took Your 2020 RMD? IRS Offering Relief via Rollover Option

Took Your 2020 RMD? IRS Offering Relief via Rollover Option

Taxpayers who took RMDs as early as January 1 now have the option to roll the funds back into a retirement account by the end of August.

As part of its provisions to help support individuals and businesses during this challenging period, the Coronavirus Aid, Relief, and Economic Security (CARES) Act suspended required minimum distributions (RMDs) for 2020. However, many taxpayers had already taken their 2020 RMD by the time this provision was passed.

On June 23, 2020, the IRS expanded the CARES Act, allowing taxpayers who already took an RMD between January 1 and June 23, 2020 from certain retirement accounts the opportunity to roll those funds back into a retirement account by August 31, 2020. Beneficiary IRA owners can also roll over previously taken 2020 RMDs through August 31.

The relief provided by this provision is broad and applies to traditional IRAs, SEP IRAs and SIMPLE IRAs, as well as 401(k), 403(b) and governmental 457(b) plans. Furthermore, the relief applies to both retirement account owners themselves and to beneficiaries taking stretch distributions.

Given the market volatility of the last few months, this change allows retirement portfolios that experienced recent declines time to potentially recover, and it might allow certain investors to draw income from more tax-efficient sources.

If you’ve already taken your RMD for 2020, there are strategies available that can allow you to return the distribution to your retirement account without tax consequences. Please contact your financial advisor for more information. He or she can work with your tax and legal professionals to determine how this legislation affects you directly.

Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website’s users and/or members. Raymond James does not provide tax or legal services. Please discuss these matters with the appropriate professional.

Economy Experiencing a Strong Initial Rebound; What Follows?

Economy Experiencing a Strong Initial Rebound; What Follows?

The initial economic rebound seen in recent weeks won’t bring us back to pre-pandemic levels, explains Chief Economist Scott Brown. “A full recovery will take time.”

Key takeaways

•As states have relaxed social distancing guidelines, growth has picked up sharply.

•Federal support has played a key role in countering the economic effects of the pandemic.

•The recession began in February and may have ended in April or May – the shortest on record. That just means that the economy began growing again, it doesn’t mean that the economy has recovered.

•The pace of recovery will depend on the virus and efforts to contain it, but it will likely be several quarters before GDP returns to its pre-pandemic level.

Efforts to contain the spread of SARS-Cov2, the strain of coronavirus that causes COVID-19, led to an unprecedented decline in U.S. economic activity this spring. As states have relaxed social distancing guidelines, growth has picked up sharply, also on an unprecedented scale. However, the initial rebound will leave us far short of where we started the year, and there’s a lot of uncertainty about the virus and the future availability of a vaccine or effective treatment against it. A full recovery will take time.

Social distancing had a major impact on several sectors of the economy, notably air travel, hotels, restaurants, retail, spectator events, and healthcare – anything where one would come into close contact with other people. Job losses in these sectors have been massive. The leisure and hospitality sector lost half of its jobs between February and April. A key concern was whether that economic weakness would snowball – that the corresponding loss of wage income would lead to further reductions in consumer spending. That spending is someone else’s income. However, second-round effects have appeared to be relatively limited thanks to government aid.

Fiscal stimulus shores up the system

Federal support has played a key role in countering the economic effects of the pandemic. Increased spending on healthcare was critical in treating the infected. “Recovery rebate” checks and expanded unemployment insurance benefits helped to shore up household income. Lending to small businesses kept many firms operating. Federal aid to the states offset strains in state and local government budgets.

The fiscal support was as unprecedented as the downturn itself. More will likely be needed. Extended unemployment benefits are set to run out at the end of July. State and local budget strains will worsen amid falling revenues and recession-related spending increases. The first three phases amounted to nearly $3 trillion, over 14% of gross domestic product (GDP). Bear in mind that the deficit was running at over $1 trillion per year prior to the pandemic, with the economy near full employment.

The Federal Reserve’s (Fed) response to the pandemic was quick and forceful. The Fed cut short-term interest rates to effectively zero in early March and restarted asset purchases (quantitative easing). It relaunched liquidity and lending facilities that it had employed during the financial crisis and created some new ones. The size of the Fed’s balance sheet rose from around $4.2 trillion in late February to $7.1 trillion at the end of June.

Budget deficits and inflation

Many investors are concerned about the government’s ability to repay the additional borrowing. However, the government is nothing like a household. The government only has to make interest payments and be able to roll over maturing debt. That’s not a problem currently. Interest rates are low and are expected to remain so over the long term. While the federal government has been borrowing more in the near term, the Fed has increased its holdings of Treasury securities. Private savings have increased and the demand for safe assets is strong.

Still, the federal budget was on an unsustainable path before the pandemic. Federal debt was rising as a percent of GDP. At some point, beyond the pandemic, lawmakers will have to work to bring the deficit in line. That doesn’t mean balancing the budget. Rather, we should try to have the national debt stable or falling as a percent of GDP over time. Lower deficits will require higher taxes, cuts to entitlement and other spending programs, or some combination. However, there is no rush. The bigger dangers are not doing enough to back up the economy in the near term and ending support too soon. Budget austerity may have broad political support, but it would make the recovery weaker.

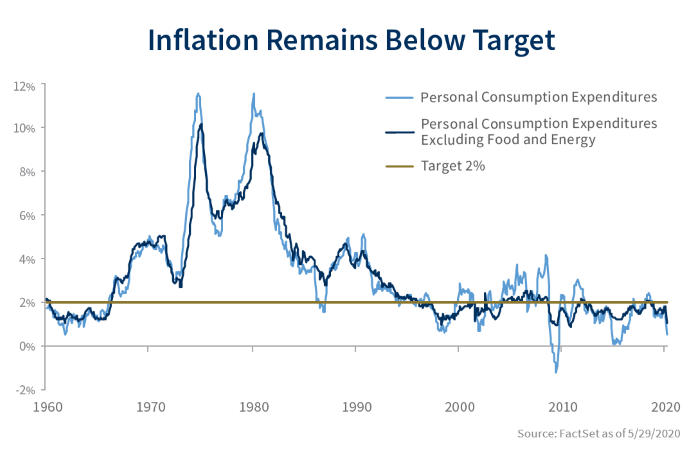

Some investors worry that the Fed’s efforts will fuel higher inflation. This is the same concern that was expressed during the financial crisis. Inflation is a monetary phenomenon. Yet, the relationships between growth, inflation, and the money supply broke down in the early 1990s. For the most part, the Fed views inflation as driven by inflation expectations and pressures in resource markets – capital, labor, and raw materials. Following the great inflation of the 1970s and early 1980s, the Fed spent decades establishing its credibility as an inflation fighter and was perhaps a little too successful in keeping inflation low. It has struggled to achieve its 2% inflation goal over the last several years. Importantly, the Fed and other central banks around the world have not abandoned their inflation goals. There is no conspiracy to monetize the debt.

The pandemic has shifted from a supply shock to a demand shock. There is excess productive capacity globally. While there may be some bottleneck inflation pressures as economies around the world begin to recover and supply chains are adjusted, significant inflation pressures in capital and raw materials are unlikely. In the U.S., the labor market is the widest channel for inflation. Labor cost pressures are expected to be mixed, but generally moderate. In the near term, high unemployment should keep wage increases in check, although job losses have been highest at the low end where there wasn’t much pressure to begin with.

Recession and recovery

The recession began in February and may have ended in April or May. That would be the shortest downturn on record. That doesn’t mean that the economy has recovered; it simply means that the economy began growing again. As the downturn was unprecedentedly large and swift, the initial rebound will be exceptionally strong and investors have eagerly embraced that view. Economists expect that third quarter GDP growth will be the strongest ever recorded, led by a sharp rebound in consumer spending. With the ability to spend limited in the downturn, savings improved, and that should fuel spending in the near term. However, the initial rebound will leave the level of GDP far below where it was at the end of 2019.

Looking ahead, the pace of recovery will depend on the virus and efforts to contain it, but it will likely be several quarters before GDP returns to its pre-pandemic level. It will take the economy even longer for GDP to get back to its previous trend. Absent a vaccine or effective treatment, the sectors affected most by social distancing can be expected to recover gradually. We could have some luck with the development of a vaccine, but risks to the outlook into next year appear predominately to the downside.

One fear is that reopening the economy too soon raises the risk of a second wave of infections and a more prolonged period of social distancing. More likely, the U.S. has implicitly settled on a trade-off between economic activity and a moderate pace of new infections and deaths.

Severe recessions usually leave long-lasting impacts on economic activity. Consumer behavior and global trade are unlikely to return to previous patterns. While the recent improvement in the economy is welcome, there will be significant long-term damage in some sectors. As Fed Chair Powell noted, the coronavirus has taken a human and economic toll and “the burden has fallen most heavily on those least able to bear it.”

Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website’s users and/or members. Raymond James does not provide tax or legal services. Please discuss these matters with the appropriate professional.

From the Desk of Dale Crossley and Evan Shear

From the Desk of Dale Crossley and Evan Shear

“In a Blink of an Eye”

It seems like all of our lives have been drastically altered in the blink of an eye. Not that anyone needs a reminder of what we have all been going through, but from a market standpoint, we hit a high on 2/19 and then within a few weeks we were deep in a bear market for the first time in over 10 years. From a low of around 30% down for the year, the markets have tried to find some footing as of the writing of this article. It will take some time for our economy to heal, but we are certain it will.

More importantly, our lives and how we live has changed. For us personally, we have been working remotely since early on in this pandemic. Our homes and home offices have become our war rooms and our trading floors. We have done numerous Zoom meetings and even Dale, who admittedly isn’t the best with technology, has become more proficient with it. My kids are all home and my oldest son’s sophomore college baseball season came to an abrupt end. The shining light of this new lifestyle is the nightly family meals and marathon UNO games. I’ve been trying to look for the joy in this crisis and family and friends, including our clients, have definitely been the best part. We have heard from many of you checking in with us, not just to see how your portfolios are doing, but rather how WE are doing. We want you to know that these calls and notes have a special place in the hearts of our entire team.

This is certainly not the crisis any of us foresaw when we started discussing the possibility of a coming recession or market volatility. For the most part we have weathered it rather well with our tactical models and time-tested strategies. Having a plan and sticking with it is vital when times of stress hit us, both financially and personally. It’s when we allow emotions to take over that we have seen the most destruction to wealth – not only today, but in the past. We appreciate the faith and trust you have all given to Dale, myself and the entire firm and hope you realize how special you are all to us.

Take care,

Evan

As Evan mentioned, emotional financial decisions are rarely helpful and often devastating. This has been a very trying time for us all, but also very interesting. As a student of behavioral finance every day provides an opportunity to learn. Within minutes we can receive completely opposite questions or concerns from clients, sometimes it might even be the same person. "Should we be going to cash to stop the bleeding?” "Should we be buying to take advantage of the downturn?" More than anything we are thankful that you have all entrusted us to answer these questions for you and your families. We are humbled to be able to lead, guide and direct you.

We certainly don't have all the answers, but our commitment has and will always be to put your interests above our own. In an effort to do that, we will continue to separate the narrative from the data and do the requisite research and continuing education to ensure that we are giving the best possible advice to keep you on track to reach your goals. That is the promise of our entire team.

The markets will recover, because they ALWAYS do. They will start the recovery before the news says, “all clear.” Our country will recover, because it ALWAYS does. That doesn't mean perfect. It will never be perfect. Don't bet against our Country. Don't bet against our scientists, our doctors and healthcare workers, our entrepreneurs, our philanthropists, or our people.

We encourage you to take what extra time this tragedy has afforded you to reexamine what's truly important to you. I am thankful for being able to use this time to reconnect with family and friends, even if mostly remotely. Reach out and check on people. Let your loved ones know how you feel. Reexamine your health plan, diet and fitness. Read a book. Take a walk. Finish a project. Learn something new.

This has no doubt been a roller coaster ride and will continue to be for the near future. Unfortunately, it’s only the scary part of the ride, without any of the fun. Do your best to separate the narrative from the data. This may mean turning off the TV for a few days. Everyone please take care of yourself and your family. Many things have changed forever, but we will recover and be stronger than ever. This too shall pass.

Take care,

Dale

Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website’s users and/or members. Raymond James does not provide tax or legal services. Please discuss these matters with the appropriate professional.