Archive for the ‘Newsletter’ Category

CrossleyShear Wealth Management's Media

Don’t Underestimate One of Your Most Precious Resources… Time

Don't Underestimate One of Your Most Precious Resources... Time

Doug Drabik discusses fixed income market conditions and offers insight for bond investors.

"Ongoing perfect timing of the markets is impossible, yet time is efficiently critical and absolutely irreplaceable. Don’t let irreplaceable moments vanish in pursuit of an expected impossible execution."

No matter where interest rates are, at 10% or 1%, it is highly probable that your portfolio requires some level of principal protection. Principal protection knows no interest rate level. You cannot control interest rates but you can control how you choose to protect the assets that you don’t want to lose. Individual bonds are a critical component of long term investment and long term investment strategies. Substitute investment products come with some risk trade-off which is completely counter-intuitive to the protection being sought.

When interest rates are low, protecting your principal comes at the expense of lower levels of income. This is one of those instances where discipline to long term thinking and benefits are fundamental to most investor’s ultimate goal of protecting what they have. It is easier to protect your principal than to replace it. Stay Disciplined. Stay invested. Stay appropriately allocated to wealth preservation assets.

This market has made income generation challenging but individual bonds balance growth assets as well as protect principal. Our ongoing mission is to discuss ways to hold on to what you’ve earned with analytical and sound long term thinking regarding how to invest and retain this wealth. Portfolio optimization commands lifetime discipline with the use of both growth assets and individual bonds. Time is a most valuable resource that if lost, cannot be recovered so don’t waste or lose it… stay invested and appropriately allocated.

To learn more about the risks and rewards of investing in fixed income, please access the Securities Industry and Financial Markets Association’s “Learn More” section of investinginbonds.com, FINRA’s “Smart Bond Investing” section of finra.org, and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) “Education Center” section of emma.msrb.org.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Stocks are appropriate for investors who have a more aggressive investment objective, since they fluctuate in value and involve risks including the possible loss of capital. Dividends will fluctuate and are not guaranteed. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website’s users and/or members. Raymond James does not provide tax or legal services. Please discuss these matters with the appropriate professional.

Did You Know 529s Are Powerful Estate Planning Tools?

Did You Know 529s Are Powerful Estate Planning Tools?

Most of us associate 529 accounts as college savings vehicles. They’re flexible, allowing you to transfer assets to anyone, including yourself, for the express purpose of furthering the education of your beneficiary. But did you know that a 529 can be a powerful estate planning tool, too?

Modern estate planning

Not everyone is in a position to set aside money for the next generation without jeopardizing their own goals, but if you’re fortunate enough to do so, it’s worth looking into your options.

Specialized savings accounts, informally referred to as 529s, could be at the top of your list. They have quite a few advantages for the beneficiaries – but there are benefits for the donors, too, given the high maximum contribution limits and tax advantages.

The special tax rules that govern these accounts allows you to pare down your taxable estate, potentially minimizing future federal gift and estate taxes. Right now, the lifetime exclusion is $11.58 million per person, so most of us don’t have to worry about our estates exceeding that limit. But that new threshold is due to revert back to just over $5 million per person by 2025.

The framework

Under the rules that uniquely govern 529s, you can make a lump-sum contribution to a 529 plan up to five times the annual limit of $15,000. That means you can gift $75,000 per recipient ($150,000 for married couples), as long as you denote your five-year gift on your federal tax return and do not make any more gifts to the same recipient during that five-year period. However, you can elect to give another lump sum after those five years are up. In the meantime, your investments have the luxury of time to compound and potentially grow.

So if you’re following along, that $150,000 gift per beneficiary won’t incur gift tax as long as you and your spouse follow the rules. You’ll also whittle your taxable estate by that same amount, potentially reducing future estate tax liabilities. That’s because contributions to 529s are considered a completed gift from the donor to the beneficiary.

Other benefits

Many people worry that gifting large chunks of money to a 529 means they’ll irrevocably give up control of those assets. However, 529s allow you quite a bit of control, especially if you title the account in your name. At any point, you can get your money back. Of course, that means it becomes part of your taxable estate again subject to your nominal federal tax rate, and you’ll have to pay an additional 10% penalty on the earnings portion of the withdrawal if you don’t use the money for your designated beneficiary’s qualified education expenses.

If your chosen beneficiary receives a scholarship or financial aid, they may not need some or all of the money you’ve stashed away in a 529. So you’ve got options here, too.

- You can earmark the money for other types of education, like graduate school.

- You can change the beneficiary to another member of the family (ideally in the same generation), as many times as you like, since most 529s have no time limits. This option is particularly helpful if your original beneficiary chooses not to go to college at all.

- You can take the money and pay the taxes on any gains. Normally, you’d expect to pay a penalty on the earnings, too. But that’s not the case for scholarships. The penalty is waived on amounts equal to the scholarship as long as they’re withdrawn the same year the scholarship is received, effectively turning your tax-free 529 into a tax-deferred investment. Of course, you can always use the funds to pay for other qualified education expenses, like room and board, books and supplies, too.

Plus, many plans offer you several investment choices, including diversified portfolios allocated among stocks, bonds, mutual funds, CDs and money market instruments, as well as age-based portfolios that are more growth-oriented for younger beneficiaries and less aggressive for those nearing college age.

Bottom line

Saving for college takes discipline, as does estate planning. Talk to your professional advisor about the nuances of different investment strategies and vehicles before making a years-long commitment.

Sources: Mercer; Broadridge/Forefield

Earnings in 529 plans are not subject to federal tax and in most cases state tax, as long as you use withdrawals for eligible college expenses, such as tuition and room and board. However, if you withdraw money from a 529 plan and do not use it on an eligible higher education expense, you generally will be subject to income tax and an additional 10% federal tax penalty on earnings. As with other investments, there are generally fees and expenses associated with participation in a 529 plan. There is also a risk that these plans may lose money or not perform well enough to cover college costs as anticipated. Most states offer their own 529 programs, which may provide advantages and benefits exclusively for their residents. An investor should consider, before investing, whether the investor’s or designated beneficiary’s home state offers any state tax or other benefits that are only available for investments in such state’s qualified tuition program. Such benefits include financial aid, scholarship funds, and protection from creditors. The tax implications can vary significantly from state to state.

Please note, changes in tax laws may occur at any time and could have a substantial impact upon each person's situation. You should contact your tax advisor concerning your particular situation. Every investor’s situation is unique and you should consider your investment goals, risk tolerance and time horizon before making any investment. Investing involves risk and you may incur a profit or loss regardless of strategy selected.

Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website’s users and/or members. Raymond James does not provide tax or legal services. Please discuss these matters with the appropriate professional.

Making the Most of Medicare’s Open Enrollment Period

Making the Most of Medicare's Open Enrollment Period

Ask yourself a few questions to make sure you're getting the most from Medicare.

Mark your calendar for Medicare’s open enrollment season: between Oct. 15 and Dec. 7, you are able to make changes to your Medicare Advantage plan and prescription drug coverage.

During this time, you can change from Original Medicare to a Medicare Advantage plan or vice versa or switch from one Medicare Advantage plan to another Medicare Advantage plan. You can also join a Medicare Advantage or Medicare prescription drug plan for the first time, or drop your drug coverage completely.

Even if you’re satisfied with your current plan, open enrollment presents a great opportunity to make sure you’re getting the most out of Medicare. Every year you should compare your current plan to other plans in your area in case another plan offers better health and/or drug coverage at more affordable prices.

The coverage provided by insurance companies often changes each year and could result in paying more out-of-pocket on healthcare expenses throughout the year. Here are some tips to help you get started.

- Ask yourself some important questions: Have your needs changed? Is your current coverage adequate? Will the cost of your current plan be going up? Are there comparable, lower-cost plans available?

- Review the annual notice of change from your current plan provider. You should receive this in September.

- If you have a Medicare Advantage plan, make sure your doctor is still accepting your particular plan next year. If your doctor is out of network, you will have to choose a new plan or pay higher out-of-pocket costs.

- Carefully review your plan for prescription drug coverage and determine your copayment and coinsurance costs.

- If you switch from a Medicare Advantage plan to Original Medicare, you will want to join a stand-alone Part D plan to get Medicare drug coverage.

- Compare plans using the Medicare Plan Finder at medicare.gov.

- Get one-on-one assistance from the State Health Insurance Assistance Program.

- Call the Medicare Rights Center at 800.333.4114 for free counseling.

- All changes to your Medicare plan will take effect Jan. 1 of the next year.

Medicare decisions can be complicated. If you have any questions about open enrollment, or if you’d like to discuss how healthcare costs factor into your overall financial plan, please contact your financial advisor.

Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website’s users and/or members. Raymond James does not provide tax or legal services. Please discuss these matters with the appropriate professional.

From the Desk of Dale Crossley and Evan Shear

From the Desk of Dale Crossley and Evan Shear

We hope that you and your loved ones are doing well and beginning to enjoy our new-found flexibility to get back to “normal.” In this issue of The Journey, we’ve included articles on "Day one of the rest of your life", "How Cyber Savvy are you", "Mitigating Surtaxes Faced by High-income Earners" and "Raising Smart Spenders and Savers" as well as a very brief survey (4 questions) about your future meeting preferences and satisfaction as a valued client. We would greatly appreciate your feedback as we are continually seeking improved ways to serve you.

It’s no surprise that we’ve been having a lot of discussions about inflation with many of you. As the press has a way of doing, the subject is generating a lot of headlines and predictions about what we can expect moving forward. There’s increasing concern due to a sharp rise in commodity prices and the mounting federal deficit from recent and proposed spending in support of the economic recovery. The pandemic affected the supply chain and now pent up demand for everything from cars to dishwashers is leading to higher prices. Thought leaders in the industry and at the Fed largely believe that the increase in inflation is associated with the reopening and it’s temporary, believing that production will eventually catch up to meet the level of demand for goods.

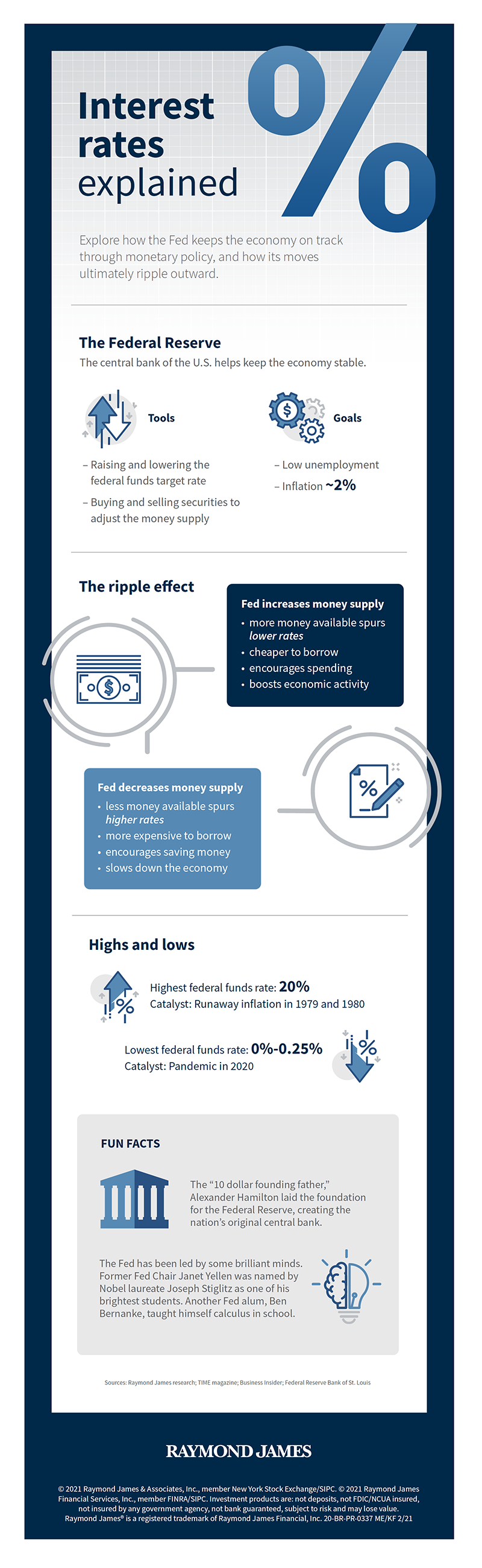

Our minds (if you’re old enough) instinctively leap to the high interest rates that plagued the 1970’s and 1980’s. With inflation concerns leading to interest rate hike worries, several of our clients have shared concerns about how their financial plan may be impacted. The infographic below on monetary policy explains the role that the Federal Reserve has in the give and take of adjusting interest rates. As concerns about inflation - even temporary - have grown, the Fed has pledged to keep interest rates low to continue supporting the recovery from the COVID-19 economic fallout. However, once the Fed’s goals for the economy are eventually met, interest rates may begin to rise.

We hope you enjoy this edition of The Journey. As always, please reach out with any questions or concerns. That’s what we’re here for.

Take care and stay well!

Evan Shear Dale Crossley, JD

CERTIFIED FINANCIAL PLANNERTM Financial Planner

Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website’s users and/or members. Raymond James does not provide tax or legal services. Please discuss these matters with the appropriate professional.

There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. All opinions are as of this date and are subject to change without notice. Past performance is not a guarantee of future results.

Survey Questions

Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website’s users and/or members. Raymond James does not provide tax or legal services. Please discuss these matters with the appropriate professional.