From the Desk of Dale Crossley and Evan Shear

We hope this edition of The Journey finds you and your loved ones well. In light of the calls received over the past several months about the economy and market conditions, we thought it would be helpful to address a few frequently asked questions below. As always, please don’t hesitate to contact us if you have additional questions or needs. We’re always here to help.

Frequently Asked Questions

Question 1: When will we know the market is improving? Is the market improving?

The rainbow appears before the end of the storm. Generally, a bear market is already doing better before good news hits investors. Bear markets follow a pattern and it’s not always easy to identify what stage we’re in.

1. What’s going on? The first indications of a bear market are generally passed off as a bad day or week in the markets. Most investors understand the markets frequently rise and fall and reacting every time the markets dip is futile. Some investors try to take advantage of “bargains” at this time.

2. Bear market! Eventually, it’s obvious a market dip wasn’t just a bad week or few weeks. Panic tends to set in. At this stage, investors realize that taking advantage of “bargains” led to further losses, and the markets won’t rebound until the cause of the crash is no longer an issue.

3. The long haul. After stock prices begin to stabilize, investors recognize that losses will not be recouped overnight. Glimmers of hope occur on occasion, but then optimism is quickly lost. This is the longest period of the bear market, usually lasting several months.

4. The end. Almost nobody recognizes the end of the bear market until after it’s over and stocks are already well into their recovery. So, the rainbow appears before the end of the storm. We just need to find it!

Question 2: Am I better off investing in the stock market when it periodically crashes?

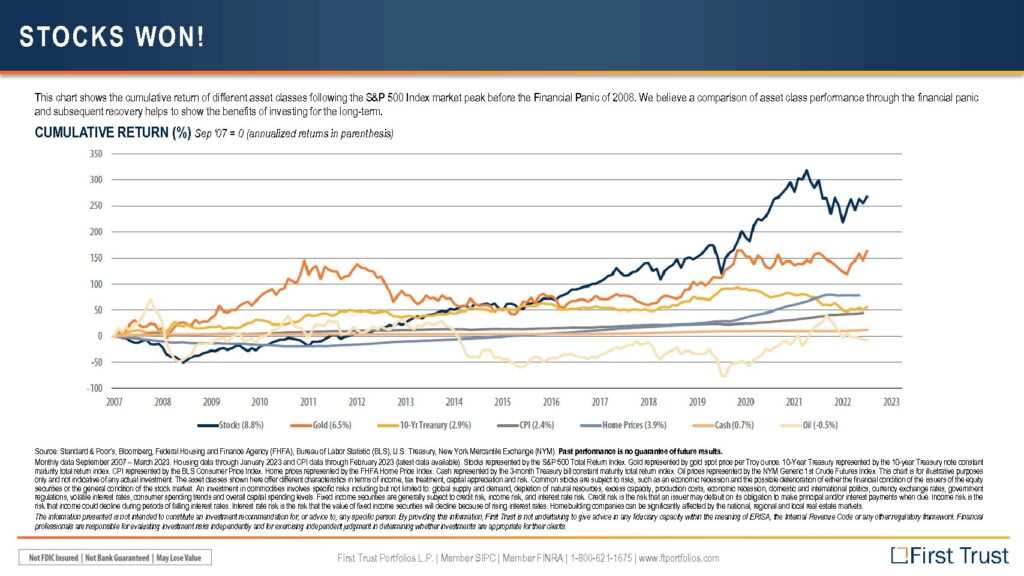

The chart below might help you breathe a little easier as we remain in stage 3 or 4 of a bull market. The chart demonstrates how the S & P since 2007 has outperformed all other types of investments in annualized returns by far, including gold, 10-year treasury note and real estate. Hopefully, this chart provides some welcome perspective and demonstrates the importance of investing for the long term.

Question 3: Is the U.S. dollar going to be replaced as the global currency?

As Michael Lebowitz states in his recent article, The Dollars Death? Not So Fast - Part One, “The old saying goes that the U.S. dollar is the cleanest shirt in the dirty laundry.” There are other currencies out there, but they are simply not suitable at this time. Rumors are plentiful that some other currency is ripe to take the place of the U.S. dollar, particularly the Chinese yuan or bitcoin. Since 1250, the world has used eight different global currencies, with a relatively short history for the U.S. dollar’s reign. The demise of each previous currency came about due to financial mismanagement. Although the U.S. dollar is certainly less stable, due to in large part our amassing trillions in debt, there’s currently no better replacement. Here’s a link to Michael Leibowitz’s full article so you can learn more and view several insightful charts and graphs.

Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website’s users and/or members. Raymond James does not provide tax or legal services. Please discuss these matters with the appropriate professional.

There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. All opinions are as of this date and are subject to change without notice. Past performance is not a guarantee of future results.