Archive for the ‘Newsletter’ Category

CrossleyShear Wealth Management's Media

From the Desk of Dale Crossley and Evan Shear

From the Desk of Dale Crossley and Evan Shear

“The stock market is a device to transfer money from the impatient to the patient.”

Warren Buffett

We’re approaching two years since the COVID-19 pandemic began, which as we can all vividly remember, caused very deep wounds on the financial markets. With pandemic stimulus support and liberal monetary policy from the Federal Reserve, the economy largely rebounded and stocks flourished in 2021. Now, we’re ringing in 2022 with the worst market start to a new year since 2016. We’re hearing from many clients who are increasingly concerned that a pullback is in full swing and a market correction (or worse) is on the horizon. Federal Reserve changes are causing concern as they appear necessary to increase interest rates and curb rising inflation. While we all dread market corrections, we inherently know they are inevitable and, as an investor, being both patient and keeping history in perspective helps navigate through these times.

Gaining Reassurance from History

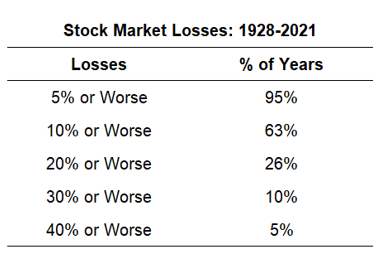

After surviving February and March of 2020 (and others this century), market fluctuations, corrections and, unfortunately, crashes are inescapable. However, in most years since 1928, we only experienced losses of 5% or slightly worse. As a matter of fact, we only experienced losses of 10% or worse in more than half of the years. Despite those fluctuations, long-term investors, who remained patient and invested, and are still very much ahead.

(These averages are skewed a little higher because of all of the crashes throughout the 1930s, but even in more modern times, stock market losses are a regular occurrence. Source: https://awealthofcommonsense.com/2022/01/how-often-should-you-expect-a-stock-market-correction/)

Is it a Pullback, Correction or Bear Market?

- We experience pullbacks in most years, which are market declines of between 5% and less than 10% from a peak.

- A correction is a loss of 10% to less than 20% from a peak. Far from uncommon, we’ve had seven since 2000.

- A bear market is relatively rare and represents a decline of 20% or more from a peak. We’ve only had three since 2000.

Keeping Perspective

As always, we remind our clients that emotional financial decisions are rarely helpful and can actually be devastating. That’s precisely why we developed Voyage, our investment and wealth building process that uses mathematical algorithms, coupled with a methodical, proprietary scoring process. Our models provide disciplined and unemotional “buy” and “sell” signals as fluctuations in the market occur. Based on these signals, client assets are then moved between stock, bond, sector, money market mutual funds and exchange-traded funds. We stress patience and riding out pullbacks, corrections and bear markets. As you can see, history tells us they always rebound.

To learn more, click here to read our article “How Do Rising Interest Rates Affect Stocks.” We’ve also provided a short video recapping article.

Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website’s users and/or members. Raymond James does not provide tax or legal services. Please discuss these matters with the appropriate professional.

There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. All opinions are as of this date and are subject to change without notice. Past performance is not a guarantee of future results.

Are Your Important Documents Secure and Accessible?

Are Your Important Documents Secure and Accessible?

Keep your financial life organized with a thoughtful combination of digital and physical storage solutions.

Pop quiz: In an emergency, could your loves ones find your current will and power of attorney? If you had to evacuate your home, could you quickly get your hands on your passport, deeds and keepsakes? Are your documents in a watertight, fireproof safe, or scattered around unprotected?

It’s not enough to have the right documents – it’s also crucial to have them updated, neatly stored and accessible. Read on for five tips that can help you keep important files safe and handy.

Equip yourself for digital success

If you’d like to have a secure and organized system for paper, a scanner and a shredder are a must. Think you might need that document, but you can’t fit another thing in your file cabinet? Scan and toss, or shred if it contains sensitive data like a Social Security number.

Digital storage has many upsides. You don’t have to pay much attention to space restrictions as you would with physical files. Also, it’s easier to securely share and keep items, and you can search for files by dates or keywords.

Some fancy scanners such as the ScanSnap automatically sort documents based on file type (photo versus receipt) and name files based on scanned content. If you don’t have the budget or room for another machine, a smartphone app is a handy alternative.

One last essential tool: a service for storing and syncing your digital data in the cloud, so you don’t lose everything if your computer is stolen or damaged. Which one you choose will depend on what features are most important to you, but popular services include Dropbox, Google Drive and iCloud.

It’s also smart to take advantage of any proprietary storage features your financial advisor may offer, which allow you to securely store and share financial data with each other, as well as trusted family members, and helps them coordinate with other professionals (such as your accountant at tax time).

Think like an executor

The most crucial papers to organize are the ones those closest to you will need when you’re no longer around. This includes your will, bank statements, insurance policies and birth certificate, for starters. So put yourself in your executor’s shoes when storing estate paperwork – this kind of planning is about helping others.

Online services that organize and store all your vital details in a single convenient place are the latest innovation on this front. Some, such as Everplans, will even walk you through making a plan for everything from funeral details to healthcare wishes, sort of like TurboTax for end-of-life planning. You could also use an off-the-shelf workbook such as “The LastingMatters Organizer” to document your wishes.

As for notarized physical documents, storing them in a fireproof safe makes sense for most. Be sure your family knows where the safe itself is, how to get into it and what they can expect to find inside. You can also keep an extra copy in a safe deposit box or with your estate attorney.

Know what to keep

Certain official records deserve physical safekeeping: passports, Social Security cards, birth certificates and adoption decrees, property and vehicle deeds, marriage certificates, divorce decrees, signed and notarized powers of attorney, a will and medical directive paperwork. While you can pay to get another copy of many of these, it’s better to have them and not need them than the opposite.

Design a breadcrumb trail

This tip is especially relevant for worst-case-scenario documents such as your medical directive. Experts recommend keeping a copy in your car’s glove box, as well as giving copies to your doctor and your preferred healthcare proxy. You can then list these as “in case of emergency” or ICE contacts on a card in your wallet and in your smartphone’s emergency call screen (for iPhone users, add this data in Apple Health; Android users can go to Settings > About phone > Emergency information).

Don’t forget about digital access that your loved ones will one day need, which means everything from email and bank accounts to photo and music sites. Few of us think to create a paper trail to help locate these accounts and login IDs because it might invite unauthorized access. However, there is a secure way to guide your heirs.

The first step is to make an inventory. Next, document the details in a safe place. You can use a secure spreadsheet template to get started at yourdigitalafterlife.com or you can use a service like LastPass, which has an emergency access feature that allows you to hand down passwords to heirs who can then securely maintain or close your accounts based on your wishes. If it’s your main household responsibility to pay the bills and keep tabs on financial accounts, we’re talking to you. You want to leave a legacy – not a logistical headache.

Create a command station

Productivity pros say every home office needs a central collection spot for notes, bills, reminders, paperwork and actionable items. To make this a working system, you’ll have to regularly plow through it all, whether daily or weekly. This will help free your mind to focus on the given task at hand, knowing your household has a system for tackling all the incoming paper.

Progress, not perfection

If your home office is a wreck right now, start small. Pick one tip that speaks to your specific situation and take action. What feels like a small win today could make a major, lasting difference for your loved ones.

If you’re still feeling overwhelmed, you can seek out a professional organizer or turn to your advisor. They know your financial situation and can help you focus on the record-keeping tasks that are important for your life.

Sources: Real Simple; pcmag.com; “Getting Things Done: The Art of Stress-Free Productivity;" LastPass; yourdigitalafterlife.com; Everplans; NPR’s Life Kit; keepitsafe.com

Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website’s users and/or members. Raymond James does not provide tax or legal services. Please discuss these matters with the appropriate professional.

What’s Your Money Mindset

What’s Your Money Mindset

Understanding your motivators can help you better control your wealth journey.

Sensible about dollars and cents? More carefree than careful? Planner or play-it-by-ear? Your money personality affects more than just your portfolio, it likely affects your relationships, too – with your spouse, your siblings and your children. Money means different things to different people, and it’s vital to have a conversation about your spending, investing and saving habits so that you and your family will be on the same page.

According to financial psychologist Dr. Brad Klontz, “We have beliefs clunking around in our heads, and for many of us, they’ve been passed down from our parents.” But if we take the time to dig into our partners’ attitudes as well as our own, we may be able to better appreciate what drives financial decisions, recognize roadblocks and make meaningful progress toward our shared goals.

While there are a few broad stereotypes, only you, your family and your advisor will truly understand your motivations. You may not fit squarely into any of these boxes, but you may recognize a few of your own traits or those of your loved ones somewhere in the mix.

The rookie

You’re thrifty and idealistic – and you’re likely saddled with student debt as you try to launch a rewarding career. You’re optimistic and hope to align your personal and professional lives with the values you hold dear. You’re not likely to be a big spender, but when you do spend, it’s on memory-making experiences like vacations.

Bottom line: You’re just starting out and might fear an unpredictable market. While understanding your risk tolerance is essential to investing well, remember that you need some risk to grow wealth. Fortunately, you’ve got time on your side as well as the power of compounding. Use both to your advantage.

The forward thinker

You’re a little older with an established career. You’re buying houses, having children, aiming for that corner office. You’re busy and earning more than ever, but most of your money may already be spoken for, earmarked for retirement or a child’s education. You’ve got more money than time, and varying priorities compete for attention.

Bottom line: It’s a struggle to find time to dig into your investments and manage everyday expenses as well as your emergency savings. You prefer to delegate some of those decisions to an advisor, offering input along the way.

The influencer

You work hard and play harder. You’re always hustling so you can enjoy the finer things in life. You drive a nice car, carry the latest phone and eat Instagram-worthy meals. For you, your self-worth is tied to your net worth. You believe there’s no such thing as too much money, and you splurge regularly.

Bottom line: For you, a budget may not seem exciting, but it’s a way of holding up a mirror to overspending and staving off debt. You may not enjoy sharing control over financial decisions with someone else, but a trusted source can serve as a guardrail to get you closer to your long-term goals.

The ostrich

An ostrich sticks its head in the proverbial sand and avoids thinking about money. You’re not quite sure how much you have, what you spend or what you owe. And you may feel overwhelmed when it comes to financial details.

Bottom line: Ignoring your finances could mean missing out on an employer’s 401(k) match or not understanding your household expenses should you ever need to take over. If you find money management complicated or cumbersome, rely on your advisor and automate other aspects, like bill paying or contributing to your 401(k).

The stockpiler

You watch every penny, prioritizing saving and frugality. The goal is to have more money than you need, which gives you a feeling of safety and control. You may also feel uncomfortable talking about money, even with those closest to you. If you’re tired of worrying about money, you may want to assign more of the daily details to your advisor, who can shoulder some of the responsibility.

Bottom line: Saving is a wonderful habit, but if you sock most of your money away in cash and conservative investments, you may be too risk averse. Strike a balance to help you reach your short- and long-term financial goals and enjoy the journey.

The scout

The scout is well-prepared for the long haul. You see money as a tool and are willing to use it to achieve your goals. You understand that not everything will go your way, but you’re cautiously optimistic that a long-term plan will eventually get you where you want to go – no matter what is happening in the headlines.

Bottom line: You manage money with both your head and your heart, relying on expert advice when you need it. Be sure to build a trustworthy team of professionals, including an accountant and estate planning attorney, to ensure you maintain balance in all aspects of your financial life.

Planning for your financial future, like climbing a mountain, is a journey that each of us approaches a little differently depending on what we hope to achieve, our time horizon and our willingness to take on risk at that particular moment. The one thing we all have in common is the need for a guide to help us forge a path to prosperity.

Next steps

Level up your financial prowess by:

- Being honest about your financial tendencies and identifying habits

- Talking to your family about what your shared financial goals look like

- Speaking to your advisor to determine how you can achieve your dreams

Sources: ally.com; sofi.com; motleyfool.com; nerdwallet.com; investopedia.com; moneyharmony.com; empower.me; kiplinger.com; Raymond James research; University of Minnesota

All investments are subject to risk, including loss.

Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website’s users and/or members. Raymond James does not provide tax or legal services. Please discuss these matters with the appropriate professional.

Review Retirement Plan Contribution Limits for 2022

Review Retirement Plan Contribution Limits for 2022

Consider using tax-advantaged accounts to help lower your tax bill.

Even in the wake of complex tax provisions, a key to lowering your tax bill is really quite simple: report lower taxable income.

Since few of us actually want to earn less, the next option to consider is to stash as much income as you can into tax-advantaged accounts. If you haven’t contributed the maximum amount to a qualified retirement plan at work, consider adding money while you can.

- Contribution limits for 401(k) and other retirement plans for the 2022 tax year are $20,500 or $27,000 if you’re 50 or older (2021: $19,500 and $26,000).

- Consider making additional salary deferrals if you are eligible to participate in an employer supplemental employee retirement plan (SERP). This will enable you to further maximize contributions to reduce your taxable income now and defer more compensation into later years when your tax rate may be lower.

- You can accumulate funds on a tax-deferred basis to pay for healthcare expenses through a health savings account (HSA) or flexible savings account (FSA). Your workplace may offer one, both or neither of these options, so check with your employer. HSA contribution maximums in 2022 are $3,650 for self-only and $7,300 for families, with an additional $1,000 catch-up contribution allowed for individuals age 55 or older (2021: $3,600 and $7,200). The limit for individual health FSA contributions remains $2,750 (note that dependent care FSAs have a higher cap of $10,500); employer contributions do not count toward this maximum.

- Once you maximize employer retirement plans, consider contributing to an IRA (still a $6,000/year limit, or $7,000 if you’re 50 or over). Traditional IRA contributions are tax deductible if your modified adjusted gross income is under $78,000 for individuals (phase-outs begin at $68,000) or $129,000 for joint filers (phase-outs begin at $109,000). You must establish a new IRA account by April 15, 2023, for 2022 contributions, and you have until then to make 2022 contributions to an IRA.

- If you work for yourself, consider contributing to a solo 401(k) retirement plan, SEP IRA or SIMPLE plan.

Your financial advisor can help develop a retirement account contribution strategy that’s tailored to your unique situation.

Please note, changes in tax laws may occur at any time and could have a substantial impact upon each person's situation. While we are familiar with the tax provisions of the issues presented herein, Raymond James financial advisors do not render advice on tax or legal matters. You should discuss any tax or legal matters with the appropriate professional.

Contributions to a traditional IRA may be tax-deductible depending on the taxpayer’s income, tax-filing status and other factors. Withdrawal of pre-tax contributions and/or earnings will be subject to ordinary income tax and, if taken prior to age 59 1/2, may be subject to a 10% federal tax penalty.

Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website’s users and/or members. Raymond James does not provide tax or legal services. Please discuss these matters with the appropriate professional.

Financial resolutions for 2022

Financial resolutions for 2022

Start the new year right by reviewing and revamping your financial plan.

Instead of hauling out those familiar New Year’s resolutions about keeping a journal or drinking more water, how about focusing on your financial well-being? Here’s a set of resolutions that can help ensure your long-term financial confidence.

Update your beneficiaries

If you don’t correctly document your beneficiary designations, who gets what may be determined by federal or state law, or by the default plan document used in your retirement accounts. When did you last update your designations? Have life changes (divorce, remarriage, births, deaths, state of residence) occurred since then?

Update your beneficiary listings on wills, life insurance, annuities, IRAs, 401(k)s, qualified plans and anything else that’d affect your heirs. If you’ve named a trust, have any relevant tax laws changed? Have you provided for the possibility that your primary beneficiary may die before you? Does your plan address the simultaneous death of you and your spouse? An estate attorney can help walk you through these various scenarios.

Create flexible liquidity

Cash has inflation and opportunity tradeoffs, but a lack of access can cause greater problems if you find yourself needing to draw from your investments. Finding a balance in line with your life and goals is important to avoid disrupting your long-term plans.

The right liquidity strategy will be different for every investor and could incorporate cash reserves, cash alternatives, highly liquid securities, lines of credit, margin loans or even structured lending. Multiple institutions and account owners can be used to hold more than $250,000 with FDIC guarantees.

Evaluate your retirement progress

What changes are needed given your current lifestyle and the market environment? Don’t fixate solely on your assets’ value – instead, drill down into what types of securities you hold, your expected cash flows, your contingency plans, your assumed rate of return, inflation rates and how long you’re planning for. Retirement plans have many moving parts that must be monitored on an ongoing basis.

Review your account titling

Haphazard account titling can create problems down the line. If one partner dies and an account is titled only in their name, those assets can’t be readily accessed by the survivor. The solution may be creating joint accounts, but it’s not always that simple. Titling has implications across a range of estate planning issues, as well as other situations such as Medicaid eligibility and borrowing power, too.

Develop a charitable strategy

Giving comes from the heart, but you can also do well when doing good. For example, consider whether or not it’d make sense to donate low-basis stocks in lieu of cash, or learn about establishing a donor advised fund to take an upfront deduction for contributions made over the next several years. Give, but do so with an eye toward reducing your tax liability.

Spark a family conversation

Sustaining the benefits of wealth for generations is nearly impossible without a mutual understanding among family members. Consider creating a family mission statement that outlines the shared vision for your wealth and legacy. This should include nonfinancial topics, too, like your values, expectations and important life lessons.

Digitize your record keeping

You likely receive emails, letters reports and updates from multiple accounts. Consider going paperless and centralizing important files in one place to reduce frustration and ensure easy access when needed. Your advisor may have access to secure storage tools that can help.

Invest with your values

Your portfolio should reflect what matters to you – and that can mean anything from avoiding particular industries to actively pursuing an ESG (environmental, social and governance) investing approach. So whether you want to promote the transition to clean energy, advocate for diversity and inclusion in the workplace, or support companies with strong data privacy practices, your portfolio can be tailored to reflect those priorities.

Check in with your advisor

Your advisor can offer specialized tools, impartiality and experience earned by dealing with many market cycles and client situations. Communicate openly about what’s happening in your life today and what may happen in the future. It’s difficult to manage what they aren’t aware of, so err on the side of over-communicating and establish a regular check-in schedule for the year ahead.

These suggestions are a helpful starting point, but no two long-term plans are identical – so reach out to your advisor for more specific guidance about progressing toward your goals in 2022.

Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website’s users and/or members. Raymond James does not provide tax or legal services. Please discuss these matters with the appropriate professional.