From the Desk of Dale Crossley and Evan Shear

“The stock market is a device to transfer money from the impatient to the patient.”

Warren Buffett

We’re approaching two years since the COVID-19 pandemic began, which as we can all vividly remember, caused very deep wounds on the financial markets. With pandemic stimulus support and liberal monetary policy from the Federal Reserve, the economy largely rebounded and stocks flourished in 2021. Now, we’re ringing in 2022 with the worst market start to a new year since 2016. We’re hearing from many clients who are increasingly concerned that a pullback is in full swing and a market correction (or worse) is on the horizon. Federal Reserve changes are causing concern as they appear necessary to increase interest rates and curb rising inflation. While we all dread market corrections, we inherently know they are inevitable and, as an investor, being both patient and keeping history in perspective helps navigate through these times.

Gaining Reassurance from History

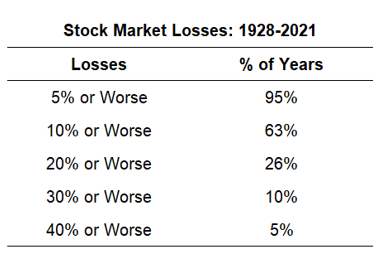

After surviving February and March of 2020 (and others this century), market fluctuations, corrections and, unfortunately, crashes are inescapable. However, in most years since 1928, we only experienced losses of 5% or slightly worse. As a matter of fact, we only experienced losses of 10% or worse in more than half of the years. Despite those fluctuations, long-term investors, who remained patient and invested, and are still very much ahead.

(These averages are skewed a little higher because of all of the crashes throughout the 1930s, but even in more modern times, stock market losses are a regular occurrence. Source: https://awealthofcommonsense.com/2022/01/how-often-should-you-expect-a-stock-market-correction/)

Is it a Pullback, Correction or Bear Market?

- We experience pullbacks in most years, which are market declines of between 5% and less than 10% from a peak.

- A correction is a loss of 10% to less than 20% from a peak. Far from uncommon, we’ve had seven since 2000.

- A bear market is relatively rare and represents a decline of 20% or more from a peak. We’ve only had three since 2000.

Keeping Perspective

As always, we remind our clients that emotional financial decisions are rarely helpful and can actually be devastating. That’s precisely why we developed Voyage, our investment and wealth building process that uses mathematical algorithms, coupled with a methodical, proprietary scoring process. Our models provide disciplined and unemotional “buy” and “sell” signals as fluctuations in the market occur. Based on these signals, client assets are then moved between stock, bond, sector, money market mutual funds and exchange-traded funds. We stress patience and riding out pullbacks, corrections and bear markets. As you can see, history tells us they always rebound.

To learn more, click here to read our article “How Do Rising Interest Rates Affect Stocks.” We’ve also provided a short video recapping article.

Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website’s users and/or members. Raymond James does not provide tax or legal services. Please discuss these matters with the appropriate professional.

There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. All opinions are as of this date and are subject to change without notice. Past performance is not a guarantee of future results.