Author Archive

Making the Most of Medicare’s Open Enrollment Period

Making the Most of Medicare's Open Enrollment Period

Ask yourself a few questions to make sure you're getting the most from Medicare.

Mark your calendar for Medicare’s open enrollment season: between Oct. 15 and Dec. 7, you are able to make changes to your Medicare Advantage plan and prescription drug coverage.

During this time, you can change from Original Medicare to a Medicare Advantage plan or vice versa or switch from one Medicare Advantage plan to another Medicare Advantage plan. You can also join a Medicare Advantage or Medicare prescription drug plan for the first time, or drop your drug coverage completely.

Even if you’re satisfied with your current plan, open enrollment presents a great opportunity to make sure you’re getting the most out of Medicare. Every year you should compare your current plan to other plans in your area in case another plan offers better health and/or drug coverage at more affordable prices.

The coverage provided by insurance companies often changes each year and could result in paying more out-of-pocket on healthcare expenses throughout the year. Here are some tips to help you get started.

- Ask yourself some important questions: Have your needs changed? Is your current coverage adequate? Will the cost of your current plan be going up? Are there comparable, lower-cost plans available?

- Review the annual notice of change from your current plan provider. You should receive this in September.

- If you have a Medicare Advantage plan, make sure your doctor is still accepting your particular plan next year. If your doctor is out of network, you will have to choose a new plan or pay higher out-of-pocket costs.

- Carefully review your plan for prescription drug coverage and determine your copayment and coinsurance costs.

- If you switch from a Medicare Advantage plan to Original Medicare, you will want to join a stand-alone Part D plan to get Medicare drug coverage.

- Compare plans using the Medicare Plan Finder at medicare.gov.

- Get one-on-one assistance from the State Health Insurance Assistance Program.

- Call the Medicare Rights Center at 800.333.4114 for free counseling.

- All changes to your Medicare plan will take effect Jan. 1 of the next year.

Medicare decisions can be complicated. If you have any questions about open enrollment, or if you’d like to discuss how healthcare costs factor into your overall financial plan, please contact your financial advisor.

Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website’s users and/or members. Raymond James does not provide tax or legal services. Please discuss these matters with the appropriate professional.

From the Desk of Dale Crossley and Evan Shear

From the Desk of Dale Crossley and Evan Shear

We hope that you and your loved ones are doing well and beginning to enjoy our new-found flexibility to get back to “normal.” In this issue of The Journey, we’ve included articles on "Day one of the rest of your life", "How Cyber Savvy are you", "Mitigating Surtaxes Faced by High-income Earners" and "Raising Smart Spenders and Savers" as well as a very brief survey (4 questions) about your future meeting preferences and satisfaction as a valued client. We would greatly appreciate your feedback as we are continually seeking improved ways to serve you.

It’s no surprise that we’ve been having a lot of discussions about inflation with many of you. As the press has a way of doing, the subject is generating a lot of headlines and predictions about what we can expect moving forward. There’s increasing concern due to a sharp rise in commodity prices and the mounting federal deficit from recent and proposed spending in support of the economic recovery. The pandemic affected the supply chain and now pent up demand for everything from cars to dishwashers is leading to higher prices. Thought leaders in the industry and at the Fed largely believe that the increase in inflation is associated with the reopening and it’s temporary, believing that production will eventually catch up to meet the level of demand for goods.

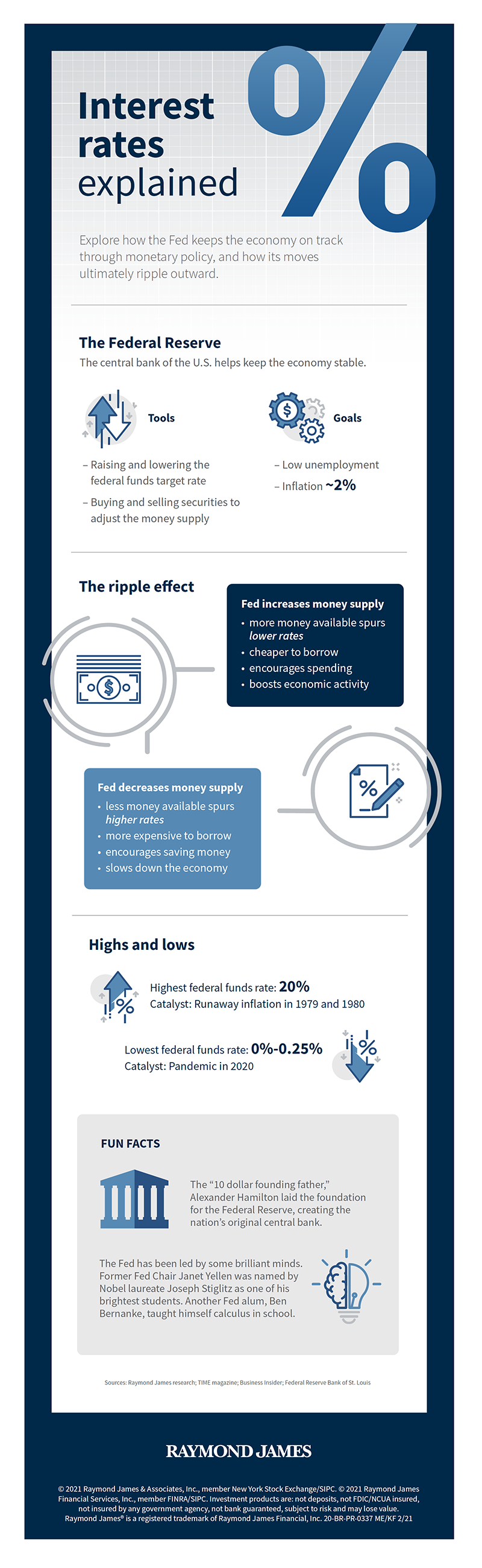

Our minds (if you’re old enough) instinctively leap to the high interest rates that plagued the 1970’s and 1980’s. With inflation concerns leading to interest rate hike worries, several of our clients have shared concerns about how their financial plan may be impacted. The infographic below on monetary policy explains the role that the Federal Reserve has in the give and take of adjusting interest rates. As concerns about inflation - even temporary - have grown, the Fed has pledged to keep interest rates low to continue supporting the recovery from the COVID-19 economic fallout. However, once the Fed’s goals for the economy are eventually met, interest rates may begin to rise.

We hope you enjoy this edition of The Journey. As always, please reach out with any questions or concerns. That’s what we’re here for.

Take care and stay well!

Evan Shear Dale Crossley, JD

CERTIFIED FINANCIAL PLANNERTM Financial Planner

Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website’s users and/or members. Raymond James does not provide tax or legal services. Please discuss these matters with the appropriate professional.

There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. All opinions are as of this date and are subject to change without notice. Past performance is not a guarantee of future results.

Survey Questions

Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website’s users and/or members. Raymond James does not provide tax or legal services. Please discuss these matters with the appropriate professional.

Mitigating Surtaxes Faced by High-Income Earners

Mitigating Surtaxes Faced by High-Income Earners

Thoughtful, proactive planning can help high-earning taxpayers reduce their net investment income tax and additional Medicare tax bills.

Every investor should have a thoughtful tax strategy, and for those that exceed certain income thresholds, proactive planning is all the more important.

Individual taxpayers with modified adjusted gross income (MAGI) of $200,000 face a 3.8% net investment income tax on the lesser of their net investment income amount or the amount by which their MAGI exceeds that $200,000 threshold. For couples filing jointly, the threshold is $250,000. These taxpayers are also subject to a 0.9% additional Medicare tax on wages and self-employment income over the same amount.

Talk to your financial advisor, along with your accountant or tax advisor, to identify and implement the strategies that are most advantageous for your situation.

Here are some options to consider.

Improve your portfolio’s tax efficiency

To get a sense of your annual tax liability, review your portfolio’s turnover ratio (the percentage of your holdings that have been replaced in a given year) and historical distributions. Then, work with your advisor to evaluate your investments, review your after-tax returns and consider opportunities to improve efficiencies.

Steps that may help to reduce taxes include tax-loss harvesting – selling securities at a loss to offset capital gains taxes – and rebalancing your portfolio to include more tax-advantaged investments, such as municipal bonds, in higher-taxed locations.

Capitalize on employer benefits

If your employer offers a salary deferral plan like a 401(k), SIMPLE IRA, 403(b) or 457 plan, maximize your contributions to reduce your adjusted gross income and taxes over the long term. Similarly, if you’re eligible, maximize contributions to an employer Supplemental Employee Retirement Plan (SERP) to reduce your taxable income now and defer the compensation into later years when your tax rate may be lower.

Another often-overlooked benefit is an employer health savings plan or flexible spending account. Contributions use pre-tax dollars, reducing your taxable income.

Develop a charitable giving plan

Charitable giving can reduce your tax burden while benefitting your favorite causes. Consider:

- Giving appreciated securities to avoid capital gains, which increase your net investment income

- Bunching several years’ worth of donations into one year to exceed the standard deduction, making itemizing advantageous, and taking the standard deduction in the years that follow

- Establishing a donor-advised fund to make future donations and claim the current income tax deduction

- Contributing highly appreciated assets to a charitable remainder trust (CRT) to defer recognition of income over time

While these tax planning strategies may help you to reduce your overall tax bill, don’t lose sight of your risk tolerance and long-term financial goals.

The process of rebalancing may result in tax consequences. While interest on municipal bonds is generally exempt from federal income tax, it may be subject to the federal alternative minimum tax, or state or local taxes. Profits and losses on federally tax-exempt bonds may be subject to capital gains tax treatment. In addition, certain municipal bonds (such as Build America Bonds) are issued without a federal tax exemption, which subjects the related interest income to federal income tax. Withdrawals from qualified accounts may be subject to income taxes, and prior to age 59½ a 10% federal penalty tax may apply.

Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website’s users and/or members. Raymond James does not provide tax or legal services. Please discuss these matters with the appropriate professional.

Raising Smart Spenders and Savers

Raising Smart Spenders and Savers

Key financial lessons to teach your children as they grow.

Talking to kids about money can be awkward, but it’s important. That’s the takeaway from a recent T. Rowe Price survey, which showed that parents consider topics like death and politics easier to discuss with kids than saving for a goal. A full 85% wanted to avoid the issue by signing their kid up for a personal finance course.

Though a class might help – and your advisor can be a valuable teacher’s aide – your kids are still taking their cues from you.

“Parents are the number one influence on their children’s financial behaviors,” Beth Kobliner, author of “Make Your Kid a Money Genius,” told Forbes. “It’s up to us to raise a generation of mindful consumers, investors, savers and givers.”

Here we offer essential financial lessons to teach your kids at each age and stage.

Ages 3-6

Don’t underestimate them – at 3, your kids can grasp basic financial concepts, and by age 7, they have already formed money habits, according to a Cambridge University study. Start with the basics, including the idea that you work to earn money in order to pay for what you want and need – and help your kids understand the difference.

Create a wants vs. needs collage: divide a sheet of paper in half and have your child cut and paste photos from magazines into the two categories.

Other money milestones mapped out by the experts at the Consumer Financial Protection Bureau include the ability to focus and persist through tasks. Saving for retirement takes large amounts of patience and self-control, so we might as well start teaching them early.

Recognizing tradeoffs is another important early milestone. Try thinking aloud when you’re grocery shopping about the amount of money you’re exchanging for a product, or have them help you compare the unit price of similar goods. Whether a trade involves money, treats or time, discuss with your child how every decision has consequences.

Around age 5, it’s important to give kids some cash to manage. A regular allowance allows them to start thinking in terms of financial tradeoffs, and you can offer them a three-part piggy bank (save, spend and share) so they begin to understand the different functions of money.

By age 6, your child should be able to focus on completing small chores to earn money and understand the value of different coins and bills well enough to sort and count them.

Ages 7-12

As your child grows, help them develop values such as empathy and gratitude. Knowing that some families live in poverty and need assistance is part of financial literacy. Using a site like Dollar Street that shows photos of different families around the world living on a variety of incomes can help. So can letting your child have a say in where the family’s charitable dollars will go.

It’s also a good idea to pass down family stories to the next generation – how your parents pitched in to help you build your business, your first big purchase, or how spending habits helped you weather the ups and downs of life. These tales can help them understand their place in the world and develop perspective on what has value in life.

These years are also a good time to have your child open a bank account, which can help them claim the identity as a “saver” and associate positive emotions with it. You should also help them track what they are earning in interest. “There’s nothing like receiving an interest payment (even if it is a few cents) in your name for the first time,” Asheesh Advani, CEO of Junior Achievement Worldwide, told Inc. magazine.

Ages 13-18+

Credit cards, investing, taxes: As your child becomes a young adult, it’s time to step up your game to help them with these complex topics and more. You can help them get started with the SIFMA Foundation’s annual Stock Market Game simulation, let them take control of buying their school supplies on a budget, or help them calculate credit card interest.

Before your teen racks up any credit card debt of their own, consider adding them as an authorized user on your card. Show them that interest accrues unless the balance is paid off – and that any late payment hurts your credit score.

Talk about which data sources can be trusted. Share how you vet financial decisions, and urge your teen to keep digging if what they’re being told doesn’t add up. For example, if your child is researching colleges, encourage them to do research beyond reading a school’s brochure.

Many successful people trace their money skills back to a formative moment: getting a job as a teen. There’s no better way to experience firsthand the effect of taxes, having a boss, being part of a team and managing your time to fit in schoolwork. A seasonal job during school holidays or a part-time gig could help your teen better grasp the working world – and how they picture themselves in it.

Finally, come up with a savings plan for long-term goals, like a car or college tuition. You can use a budgeting app (try Goalsetter or Mint) that helps them visualize their progress, keeps spending in check and gives them a sense of ownership and confidence in their future.

Start the conversation

Whether your kid is 7 or 17, they are ready to hear money talk from their parents and grandparents. After all, financial literacy is not just about dollars and cents. You’re really showing them how to think for themselves, develop values and make sound decisions. In the space of a few teachable moments, you can empower them to take control of their future – a worthy investment.

Sources: T. Rowe Price 2019 Parents, Kids & Money Survey; Forbes; Inc. magazine; CNBC Millionaire Survey; U.S. Consumer Financial Protection Bureau; Sallie Mae’s 2019 Majoring in Money report; mtmfec.org

Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website’s users and/or members. Raymond James does not provide tax or legal services. Please discuss these matters with the appropriate professional.