From the Desk of Dale Crossley and Evan Shear

We hope that you and your loved ones are doing well and beginning to enjoy our new-found flexibility to get back to “normal.” In this issue of The Journey, we’ve included articles on "Day one of the rest of your life", "How Cyber Savvy are you", "Mitigating Surtaxes Faced by High-income Earners" and "Raising Smart Spenders and Savers" as well as a very brief survey (4 questions) about your future meeting preferences and satisfaction as a valued client. We would greatly appreciate your feedback as we are continually seeking improved ways to serve you.

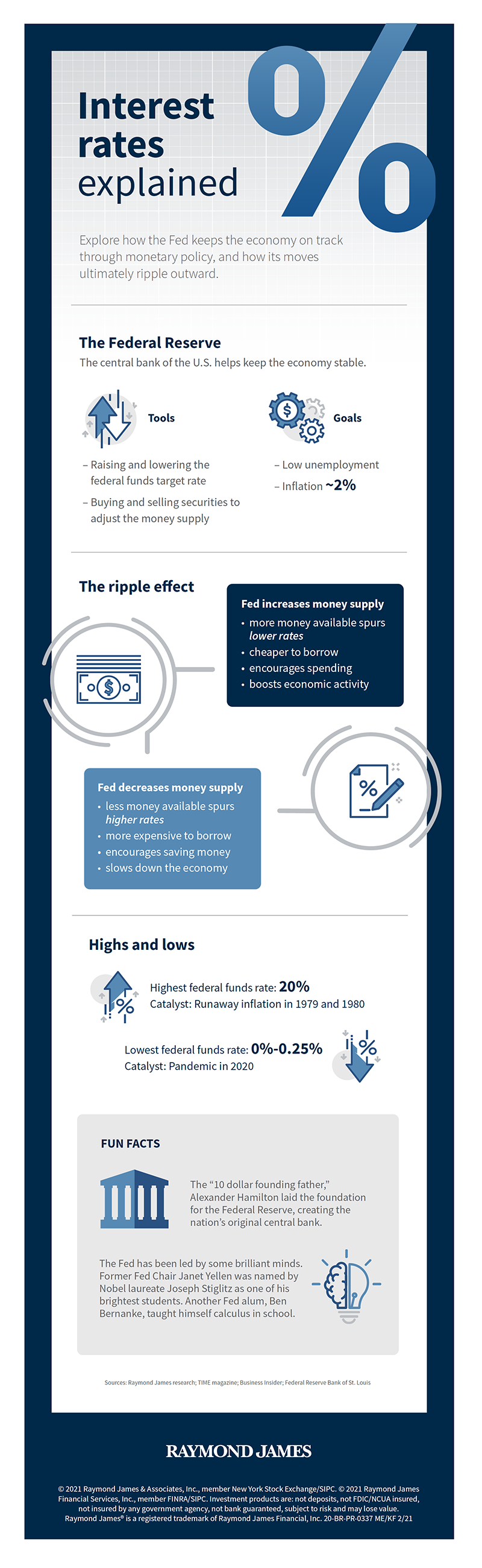

It’s no surprise that we’ve been having a lot of discussions about inflation with many of you. As the press has a way of doing, the subject is generating a lot of headlines and predictions about what we can expect moving forward. There’s increasing concern due to a sharp rise in commodity prices and the mounting federal deficit from recent and proposed spending in support of the economic recovery. The pandemic affected the supply chain and now pent up demand for everything from cars to dishwashers is leading to higher prices. Thought leaders in the industry and at the Fed largely believe that the increase in inflation is associated with the reopening and it’s temporary, believing that production will eventually catch up to meet the level of demand for goods.

Our minds (if you’re old enough) instinctively leap to the high interest rates that plagued the 1970’s and 1980’s. With inflation concerns leading to interest rate hike worries, several of our clients have shared concerns about how their financial plan may be impacted. The infographic below on monetary policy explains the role that the Federal Reserve has in the give and take of adjusting interest rates. As concerns about inflation - even temporary - have grown, the Fed has pledged to keep interest rates low to continue supporting the recovery from the COVID-19 economic fallout. However, once the Fed’s goals for the economy are eventually met, interest rates may begin to rise.

We hope you enjoy this edition of The Journey. As always, please reach out with any questions or concerns. That’s what we’re here for.

Take care and stay well!

Evan Shear W. Dale Crossley, Jr., JD, CWS®

CERTIFIED FINANCIAL PLANNERTM Financial Planner

Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website’s users and/or members. Raymond James does not provide tax or legal services. Please discuss these matters with the appropriate professional.

There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. All opinions are as of this date and are subject to change without notice. Past performance is not a guarantee of future results.