Author Archive

Netiquette for digital natives

Netiquette for digital natives

The youngest members of the family might seem the most informed on today’s tech – but that’s not always the case.

Preparing the next generation for everything, even deterring cybercriminals or tracking down lost devices, is still the responsibility of older generations. These tips can help shield young people from online danger.

Assign a “kid computer”

For younger family members, assigning separate devices to each user may lessen the risk of potentially exposing sensitive information. One IT recommendation is keeping a device solely devoted to accessing banking and other private information separate from a device used for social media apps, games and the like. This is also an opportunity to allow young internet denizens to make mistakes and learn from them without compromising your important information or frying and damaging a vital hard drive.

Teach positive online practices

Instead of installing “childproofing” apps to monitor online activity, consider teaching the importance of safe cyber-practices. The “Google Family” page is a wealth of information with its “Be Internet Awesome” resources. Here, you can find internet safety conversation starters for all ages and games like “Interland” that guide young users in spotting safety and security risks in places like “Reality River” and “Mindful Mountain.”

Track and protect what’s precious

Device tracking can help locate wandering phones, tablets, laptops and even AirPods in case they are misplaced or stolen. Activate the “Find My” app on Apple devices or “Find My Device” on Androids. Purchasing physical GPS tracking tags and placing them on nondigital items is another great way to keep track of precious cargo.

Even more important is personal safety. In case of an emergency, make sure your children know how to use the emergency SOS function and assign emergency contacts. For iPhones, this can be done in the “Health” app’s Medical ID section or in “Contacts” if you choose the “Add to Emergency Contacts” button. For Android users, you can add emergency information as text on the lock screen or in the “Personal Safety” app.

Protecting yourself from fraud

According to a 2022 IT study, an estimated 53 million U.S. citizens have been affected by online and email scams, accruing $6.9 billion in losses. Don’t allow yourself to fall victim to these preventable crimes.

It takes two

IT experts recommend using two-factor authentication to verify requests for changes in account information or password logins. These systems send a code to your smartphone or other devices to verify your identity. Secure your email by providing a phone number or backup email account. To simplify authentication even further, enable biometrics, such as face recognition or your fingerprint on your devices.

Use the “zero trust” approach

In cybersecurity, this model’s motto is to “never trust and always verify.” This often means becoming an internet detective and taking extra time before responding to strange-looking texts or emails. Ensure the URL in any communication is associated with the business or individual it claims to be from and note if hyperlinks or the message contain misspellings. Refrain from supplying any login credentials and verify the email address used to send the communication by looking at your contacts first to see if it matches up. Be sure to monitor your personal financial accounts on a regular basis for anomalies like one-cent charges from unknown sources.

Learn when to unplug

Even the volunteer IT person needs some rest. Step away from your devices by setting up the “Do Not Disturb” function. Apple users can use “Focus” and Androids can use “Do Not Disturb” settings to choose certain people or apps that can still notify you when everything else is silenced. You can also use Apple’s “Screentime” app as well as Android’s “Digital Wellbeing” tools to limit time on more addictive games and social media scrolling.

Seeking more support? Remember, your trusted financial advisor also has tools to help fight off financial fraud and can point you in the right direction for safeguarding finances online.

Sources: forbes.com; aag-it.com; ic3.gov; wsj.com; goodhousekeeping.com; consumerreports.org; washingtonpost.com

Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website’s users and/or members. Raymond James does not provide tax or legal services. Please discuss these matters with the appropriate professional.

5 considerations for your Social Security strategy

5 considerations for your Social Security strategy

As you prepare to start claiming benefits, be sure to ask yourself these questions.

This year, about 67 million Americans will receive over one trillion dollars in Social Security benefits. If you’re planning to join that total and claim your benefits, timing, strategy and sound decisions can all help you maximize the outcome for your household. When and how you claim, your marital status, your health, and even whether you have dependents can all affect what benefits you receive.

To get the most out of your hard-earned benefits, focus on developing the right plan for you and your family. Doing so could help you enjoy a comfortable retirement.

Where do I start?

Given the complexities involved in claiming benefits, creating a plan of action for Social Security can seem overwhelming. Fortunately, you don’t have to go it alone. Your financial advisor can help you develop an appropriate retirement income strategy based on your individual circumstances – but there are a few key questions you can ask yourself beforehand to jumpstart the conversation.

Five key considerations

Before making any decisions, it’s important to consider the elements of your life that could influence your individualized Social Security strategy. To prepare for your meeting with your advisor, start thinking through these key questions:

When are you planning to retire? Is this date relatively fixed, or is it more flexible?

What will your earnings look like if you continue to work past the age of 62? Would these come from continuing in your current role, or are you considering taking on new or part-time work down the road?

What other sources of income will you have in retirement? In addition to your Social Security benefits, will you be receiving any pension payments, employment income (part-time work) or annuity payouts? What about any business sale proceeds, insurance policies or inheritances? And of course, consider any retirement accounts or additional savings you've built up over the years.

How long do you expect to live? Consider your current health as well as your family history.

What does your family situation look like? Are you single, married or divorced? Do you have any dependents?

As you think through these questions and begin shaping a strategy with your advisor, consider creating a free “My Social Security” account at SSA.gov. Within your account, you can review a statement detailing your estimated benefits as well as explore other resources for developing a sound plan.

Sources: SSA.gov

Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website’s users and/or members. Raymond James does not provide tax or legal services. Please discuss these matters with the appropriate professional.

25th Anniversary Gala

Save the Date 25th Anniversary Gala

October 28th | 6:15 pm–10:00 pm

Kennedy Space Center, Atlantis venue

Join us under the space shuttle Atlantis as we celebrate our success over the past 25 years. We couldn’t have made it this far without you! The festivities will include dinner, drinks, live music and dancing, too!

* Invitations will be sent six weeks prior to event with a link to RSVP. Dress will be black tie optional.

Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website’s users and/or members. Raymond James does not provide tax or legal services. Please discuss these matters with the appropriate professional.

From the Desk of Dale Crossley and Evan Shear

From the Desk of Dale Crossley and Evan Shear

We hope you and your family are enjoying a relaxing summer. While there is still time to savor the rest of the season, this coming month marks preparations for a new school year and often prompts families to consider education expenses and planning. With the average cost of a four-year college degree approaching $150,000, we thought it would be helpful to share some helpful articles on education funding. As you review the many tax-free savings and estate planning benefits, there is no one-size-fits-all approach, so we can help you find the best options to suit your financial plan.

A popular education investment account is a 529 plan, a tax-advantaged investment account designed to help families save money for a child’s education. A recent update to the Secure 2.0 Act will soon provide an opportunity to revamp savings by allowing beneficiaries to make tax-free and penalty-free rollovers from 529 plans into a Roth IRA for a portion of the unused funds. This new law helps remove concerns about overfunding a 529 college savings account and ensures that families that save for their child’s education are not later penalized. This article offers important information on the eligibility and requirements of this provision in order to reposition money in a 529 plan in the event it isn't used for education.

Additionally, these education planning resources offer further valuable information on the benefits of a 529 plan, such as which education expenses qualify, how it compares to other savings strategies, and how it can be used as an estate planning tool. In addition, there’s an article on the benefits of using a securities-based line of credit (SBL) instead of student loans.

We hope you find these resources a helpful starting point to further discussions with your planner. Please feel free to contact us for guidance throughout this process and for help examining which options best align with your needs and goals.

Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website’s users and/or members. Raymond James does not provide tax or legal services. Please discuss these matters with the appropriate professional.

There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. All opinions are as of this date and are subject to change without notice. Past performance is not a guarantee of future results.

Raymond James does not provide tax or legal services. As with other investments, there are generally fees and expenses associated with participation in a 529 plan. There is also a risk that these plans may lose money or not perform well enough to cover college costs as anticipated. Most states offer their own 529 programs, which may provide advantages and benefits exclusively for their residents. Investors should consider, before investing, whether the investor’s or the designated beneficiary’s home state offers any tax or other benefits that are only available for investment in such state’s 529 college savings plan. Such benefits include financial aid, scholarship funds and protection from creditors. The tax implications can vary significantly from state to state.

From the Desk of Dale Crossley and Evan Shear

From the Desk of Dale Crossley and Evan Shear

We hope this edition of The Journey finds you and your loved ones well. In light of the calls received over the past several months about the economy and market conditions, we thought it would be helpful to address a few frequently asked questions below. As always, please don’t hesitate to contact us if you have additional questions or needs. We’re always here to help.

Frequently Asked Questions

Question 1: When will we know the market is improving? Is the market improving?

The rainbow appears before the end of the storm. Generally, a bear market is already doing better before good news hits investors. Bear markets follow a pattern and it’s not always easy to identify what stage we’re in.

1. What’s going on? The first indications of a bear market are generally passed off as a bad day or week in the markets. Most investors understand the markets frequently rise and fall and reacting every time the markets dip is futile. Some investors try to take advantage of “bargains” at this time.

2. Bear market! Eventually, it’s obvious a market dip wasn’t just a bad week or few weeks. Panic tends to set in. At this stage, investors realize that taking advantage of “bargains” led to further losses, and the markets won’t rebound until the cause of the crash is no longer an issue.

3. The long haul. After stock prices begin to stabilize, investors recognize that losses will not be recouped overnight. Glimmers of hope occur on occasion, but then optimism is quickly lost. This is the longest period of the bear market, usually lasting several months.

4. The end. Almost nobody recognizes the end of the bear market until after it’s over and stocks are already well into their recovery. So, the rainbow appears before the end of the storm. We just need to find it!

Question 2: Am I better off investing in the stock market when it periodically crashes?

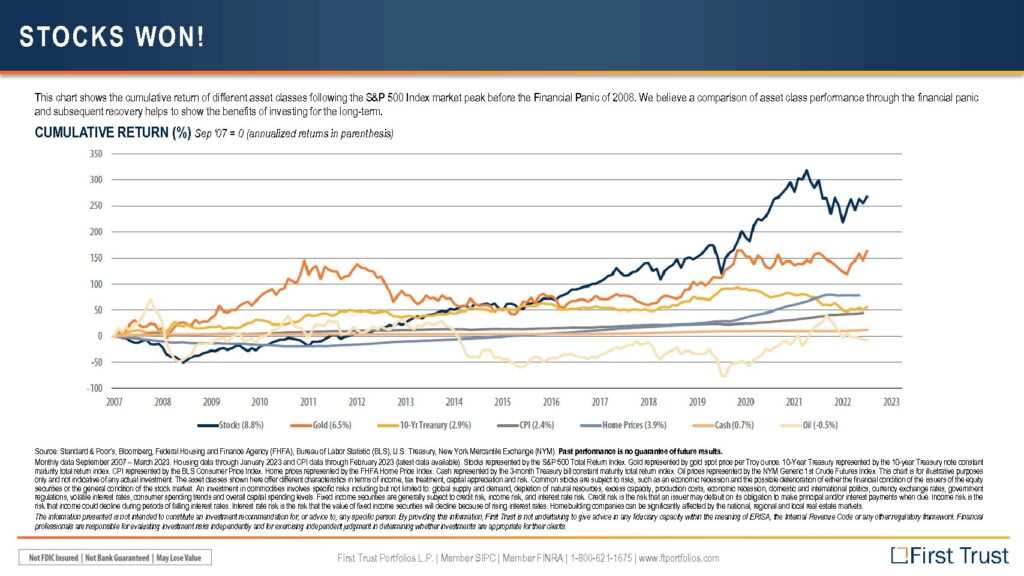

The chart below might help you breathe a little easier as we remain in stage 3 or 4 of a bull market. The chart demonstrates how the S & P since 2007 has outperformed all other types of investments in annualized returns by far, including gold, 10-year treasury note and real estate. Hopefully, this chart provides some welcome perspective and demonstrates the importance of investing for the long term.

Question 3: Is the U.S. dollar going to be replaced as the global currency?

As Michael Lebowitz states in his recent article, The Dollars Death? Not So Fast - Part One, “The old saying goes that the U.S. dollar is the cleanest shirt in the dirty laundry.” There are other currencies out there, but they are simply not suitable at this time. Rumors are plentiful that some other currency is ripe to take the place of the U.S. dollar, particularly the Chinese yuan or bitcoin. Since 1250, the world has used eight different global currencies, with a relatively short history for the U.S. dollar’s reign. The demise of each previous currency came about due to financial mismanagement. Although the U.S. dollar is certainly less stable, due to in large part our amassing trillions in debt, there’s currently no better replacement. Here’s a link to Michael Leibowitz’s full article so you can learn more and view several insightful charts and graphs.

Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website’s users and/or members. Raymond James does not provide tax or legal services. Please discuss these matters with the appropriate professional.

There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. All opinions are as of this date and are subject to change without notice. Past performance is not a guarantee of future results.