Archive for the ‘Newsletter’ Category

CrossleyShear Wealth Management's Media

Rigatoni alla Carbonara

Rigatoni alla Carbonara

Cooking Time: 30 minutes

Serves: 4

Difficulty Level: Easy

This is a classic Roman recipe. It’s impossible to go to a random ‘trattoria’ in Rome and not find Carbonara on the menu. Nevertheless, did you know that this dish was actually born in the US? In fact, its first recipe appears in “An Extraordinary Guide to What’s Cooking on Chicago’s Near North Side”, in 1952! If you think about it, the combination between bacon (Guanciale) and eggs, it’s something really American. Here is the recipe for the authentic Carbonara, the only one, that you need to follow carefully to turn out perfectly for your guests!

Ingredients

380 gr (13.4 oz) Rigatoni dry pasta

150 gr (5.2 oz) Guanciale DOP – whole piece best; alternatively, 0.25 inches thick slices. If you can’t find Guanciale, go for Pancetta or Bacon.

5 egg yolks

30 gr (1 oz) Pecorino romano DOP cheese

20 gr (0.7 oz) Parmesan Reggiano DOP

Black Peppercorns (half tablespoon)

Mediterranean Sea Salt

Directions

Bring the water to a boil in a large-sized pot.

On a cutting board, cut the Guanciale (or Pancetta) into strips of about 0.5 inches long and ¼ inch thick, taking care to dispose of the rind.

With the help of a meat mallet, crush the black peppercorns to get a coarsely ground black pepper.

Separate the yolks from the egg whites. Pour the 5 yolks into a bowl and add almost all of the Pecorino Romano DOP cheese (leaving about a tablespoon for the final garnishment), the Parmesan Reggiano DOP and the black pepper. Mix the sauce with a whisk until you get a thick cream.

In a large-sized sauté pan, add a tablespoon of EVOO and the Guanciale strips. Cook over medium heat until the Guanciale is golden brown. Turn off the burner and set aside.

Salt the boiling water, and add the rigatoni. After about 3 minutes, add half of a ladle of cooking water to the yolk sauce and mix with a whisk until a semi-liquid sauce is reached.

Drain the rigatoni when it is “al dente” (firm to the tooth) with the help of a skimmer (do not dispose of the cooking water) and put the pasta in the pan with the Guanciale, add one or two ladles of cooking water and stir on high heat for about 1 minute. Now turn off the burner (the rigatoni must have absorbed almost all the sauce). Let it cool for about 45 seconds, then pour the yolk sauce and stir with a wooden spoon (this will prevent the egg yolks from becoming scrambled).

Serve and enjoy your Carbonara immediately with the final garnishment of Pecorino and ground black pepper.

This dish pairs perfectly with Chardonnay or Frascati Superiore.

Article printed from LA CUCINA SABINA: https://www.lacucinasabina.com

URL to article: https://www.lacucinasabina.com/recipe/rigatoni-alla-carbonara/

Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website’s users and/or members. Raymond James does not provide tax or legal services. Please discuss these matters with the appropriate professional.

3 Ways to Help Loved Ones During Uncertain Times

3 Ways to Help Loved Ones During Uncertain Times

Maximize your generosity in the current environment with these gifting strategies.

World events can strike different chords for different people, even within our own families.

If you find yourself wanting to help your loved one through economic uncertainty, you’re not alone. CNBC’s Millionaire Study, a recurring survey, found that 22% of millionaires had provided assistance to their adult children since the start of the COVID-19 pandemic and 21% had given help to other family members.

It goes the other way, too. Among millennials, the oldest of whom are approaching 40, 19% provided some level of support to a parent even before the pandemic, CNBC reported. In total, about 13% of Americans provide financial assistance to a parent.

Luckily, recent changes to tax laws surrounding gifts, in conjunction with historically low interest rates, make it easier now than almost ever to help your family members in the short term – and set them up for the long term – once the economic volatility settles. The following strategies may help you meet your goals.

1. Simply cash

Few solutions can quell an immediate financial hardship like the U.S. Mint’s finest. Since 2018, individuals have been permitted to give a person up to $15,000 annually without accruing a tax liability. These annual limits generally apply to single gifter-giftee pairs, so if you are married, your spouse could give an additional $15,000 and remain below the annual exclusion limit. Further, if you want to share your generosity with the recipient’s spouse, partner, child or other trusted relation, you could gift them $15,000 as well.

Giving over $15,000 per recipient won’t necessarily bring you new tax liabilities, at least not now. You will be expected to file the gift form with your tax return and it will count against your lifetime gift limit, currently $11,580,000 for an individual and double that for a married couple, which has implications when it comes to your estate. Tax laws change, of course, and this lifetime limit is set to expire by the end of 2025, so consult your financial advisor and tax professional to run through scenarios that might be more advantageous in the current climate.

2. A loan between friends (or family)

While you may want to loan your family member what they need and have them pay it back when it’s convenient for them, the IRS is a bit more rigid when it comes to transactions that could look like gifts, so it’s best to have the appropriate documentation in place.

Now may be an opportune time to issue a loan to a family member without feeling the point of the taxman’s sharpest pencil (and his rules regarding below-market loans). The reason? The minimum interest rate, known as the Applicable Federal Rate (AFR), is historically low. In July 2020, the short-term AFR hit 0.18%, which applies to loans with a term shorter than three years. For mid-term loans – which will be paid back between three and nine years – the rate was 0.45%, and for long-term loans with a repayment schedule longer than nine years the rate was 1.17%, lower than what you’d expect to see from a commercial lender.

Just make sure the loan is a bona fide creditor-debtor agreement with payment schedules, record-keeping, a promissory note and, optionally, a collateral agreement, Forbes magazine recommends. Consult with your attorney to draw up the documents and oversee the process.

3. Transferring with equities

If market volatility has taken a bite out of your investments but not your lifestyle, there’s another way to offer your family members a long-term opportunity, especially if they’ve had to dig into their retirement support.

During volatile market periods, there could be moments when your good stocks are facing the same kind of downward pressure as all the others. On the bright side, though they may have higher value later, they could serve as an undervalued gift. This means the annual gift exclusion limit of $15,000, and lifetime limit of $11,580,000, could go a lot further than it did at the hottest point in the market.

For example, say Bradley bought XYZ for $20/share a few years ago. In December, it was priced at $50/share but hovers around $35 now. If Bradley gifts his adult daughter Mary those potentially undervalued shares, he can remove the current value from his estate and Mary will get time to, hopefully, benefit from the stock’s future growth.*

Gift recipients rarely need to worry about paying gift taxes, but they may need to pay income taxes depending on the change in value of a gifted equity when they sell. Many times it makes sense to gift appreciated assets instead to avoid rules around dual basis. The IRS also has particular rules around gifting to those in negligible tax brackets (like minors or children in college), which could trigger the so-called kiddie tax. Because this area can get a little complicated, it’s best to consult a tax professional and your financial advisor first.

Family money matters

Even with a number of practical options, as the adage states: The mixing of money and family should be treated with care. But open communication, well-defined limits and expectations, and third-party advice can help slacken the natural tension of the situation. Here are some tips from professionals:

- Know what you can give. Though it might feel worth it to delay your own retirement to help your family member, for example, know that you may be giving up years when your health, wealth and time are at their peak.

- Be clear. Setting terms, goals and timelines up front clears up confusion and creates expectations. For some types of financial assistance, like an intra-family loan, these terms will be in writing – but have a plan if things don’t work out as expected. For less structured assistance, like cash, it will be up to both sides to prevent future resentment.

- Bring in a professional. When it comes to decisions like these, it’s always best to have a cool-headed, objective third party to help out. Consult your financial advisor, tax professional and/or attorney to get things started.

*This is a hypothetical example for illustration purpose only and does not represent an actual investment.

Raymond James does not provide tax or legal services. Please discuss these matters with the appropriate professional.

Sources: CNBC; IRS; Kiplinger; NerdWallet; NPR; U.S. Treasury; Forbes.com; RaymondJames.com

Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website’s users and/or members. Raymond James does not provide tax or legal services. Please discuss these matters with the appropriate professional.

Should You File Early for Social Security?

Should You File Early for Social Security?

Waiting until full retirement age makes sense for many investors – but not for every investor.

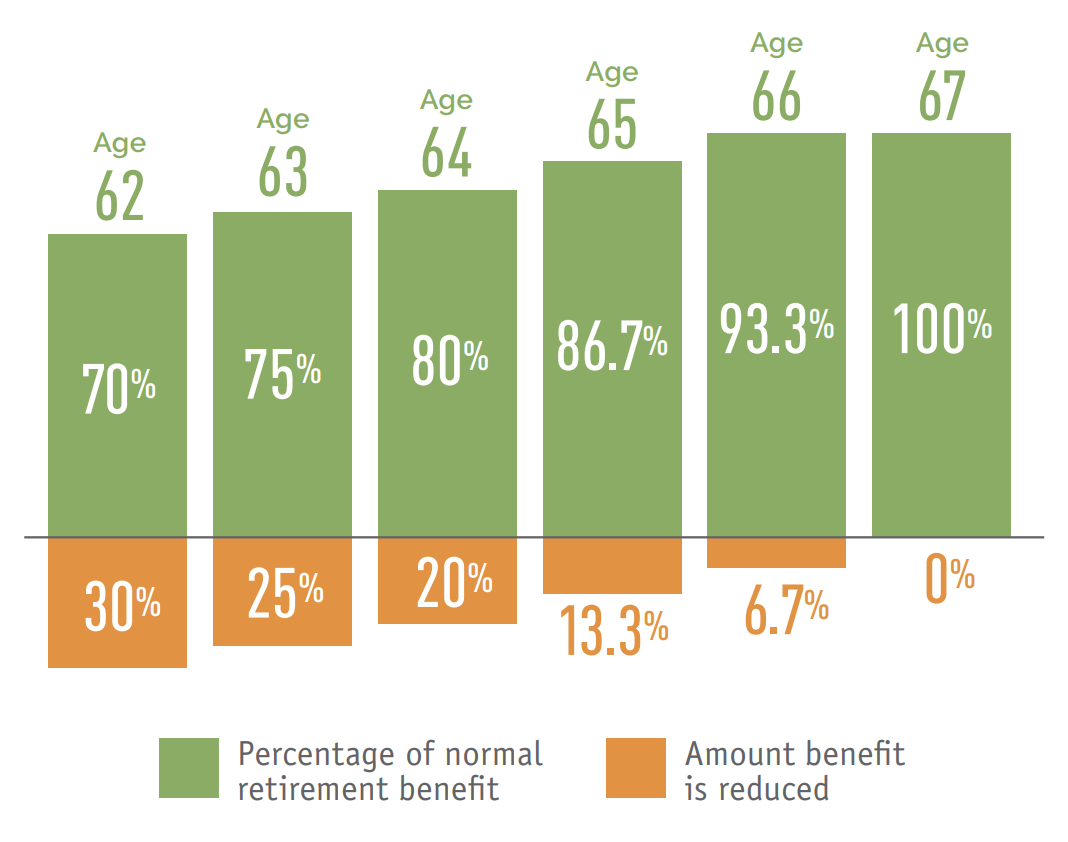

Conventional wisdom and a little bit of math tell us that waiting at least until full retirement age (between 66 and 67, depending on when you were born) will net a larger monthly payout than filing for Social Security as soon as you’re eligible at age 62. If you can wait even longer, you’ll get an 8% increase in your monthly benefits every year you delay between your full retirement age and age 70 – a potential 8% to 32% increase (a pretty impressive “rate of return” that’s hard to beat).

This assumes, of course, that you have good health as well as enough income and/or retirement savings that you can afford to wait.

But this approach may not fit every case. Depending on your financial standing, personal life expectancy and spousal situation, filing early can actually be advantageous. But make this decision carefully – remember, filing early yields a permanently reduced Social Security benefit.

Consider these three factors when deciding whether or not to file early:

Your cash needs

Sometimes, the best laid plans go awry. You may have to leave your job unexpectedly for health reasons – you may get burned out, or a business deal doesn’t go as well as hoped and you find yourself in debt. Perhaps you find yourself wanting – or needing – to spend more time with those you love. If you don’t have enough savings to retire sooner than planned, think about claiming Social Security benefits early.

Social Security offers a consistent source of income, so it can make for a great backup plan. But it’s important to really do the math and budget accordingly, since it’s unlikely to be a princely sum. Benefits are estimated to average $1,543 in January 2021, which would sum to about $18,516 per year. The maximum benefit at full retirement age for 2021 is $3,148, about $37,776 per year.

Some strong savers still like having extra income to fund more of their wants in early retirement, perhaps preferring to let dedicated retirement savings accounts continue to grow. The extra income can enhance the so-called “go-go” years, a period when we can expect to have the most time and energy when we first enter retirement.

Your health

If you live to the average life expectancy for someone your age, you’ll receive approximately the same amount over your lifetime whether you start collecting benefits sooner or later. But the math only works out if you live to your late 70s, the average American life expectancy. If you have a significant health event or have a family history of illness, filing early could be a smart option.

Your spouse

If you’re the lower-earning partner, your lifetime benefits will also be lower. Ask your advisor to calculate how to maximize your total household benefits. This plan could involve you filing earlier, and the higher-earning spouse delaying their more substantial benefits in order to get that 8% credit for each year between full retirement age and age 70. This strategy could maximize your benefits as a couple, and is also likely to secure higher survivor benefits for you when the time comes.

As with many financial decisions, the best Social Security claiming strategies need to account for your personal situation – your health, your savings, your marital status. Remember that you’re generally not eligible for Medicare until 65, so if you’re not covered by an employer, you may need to purchase your own health insurance coverage until Medicare kicks in.

It’s best to consult with your spouse and a knowledgeable financial advisor to help maximize this important source of recurring, inflation-adjusted and guaranteed income. Your advisor can help you run some calculations to maximize your household and lifetime Social Security benefits, which will help you and your spouse determine the most appropriate time to file.

Sources: Washington Post; Motley Fool; thebalance.com; cnbc.com; ssa.gov; Center for Retirement Research; investors.com

Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website’s users and/or members. Raymond James does not provide tax or legal services. Please discuss these matters with the appropriate professional.

10 Themes That Will Affect Your 2021 Investing

10 Themes That Will Affect Your 2021 Investing

The first-ever postponement of the Summer Olympics exemplifies the depths of disruption the pandemic has caused. However, the concept of the torch is associated with hope, light and strength, an excellent metaphor for the rescheduled start date – July 23, 2021 – likely coinciding with the sustainable reopening of many parts of the world.

As a salute to everyone that has done their part to make this happen – from scientists to frontline workers to the athletes themselves – and to set our sights on a more uplifting time period, we’ve chosen the Summer Games as the backdrop for our ten themes for 2021.

1. Global synchronized economic recovery: Rowing in the same direction

Nineteen of the twenty largest economies in the world experienced a contraction in growth in 2020, but we expect the entire crew to see positive growth in 2021. The coxswain of the recovery will be global central banks, led by the Federal Reserve (Fed), as its decisions to keep interest rates low and liquidity robust will ultimately dictate the power and pace of the global economic recovery.

2. U.S. economic recovery will take on a triathlon

The recovery will be defined by transitional periods with varying paces throughout the year. At the onset, worsening COVID trends and paused reopening processes will prove to be a challenge. Analogous to swimming, the first leg of the triathlon, the pace will be slower and the waters may be choppy. However, by the spring, economic growth will accelerate as the dissemination of vaccines push the pedal for more businesses to safely reopen. Toward the end of the year, we expect to reach a steadier stride, finishing at a slower but more sustainable pace.

3. Keeping portfolios en garde despite low yields

Fencing requires agility, coordination, balance, and timing – the same skill set global central banks displayed when adjusting interest rates in light of the COVID-19 pandemic. This year, acceleration in economic growth should thrust the yield back to the 1.50% level by year end, but low inflation, central bank buying, strong foreign demand and the growing economic sensitivity to higher yields will parry yields from returning to levels near 2% on a sustainable basis.

4. Earnings will do the heavy lifting

We remain positive on equities over the next 12 months, but it will be a powerful earnings rebound (20%+ earnings per share growth in 2021) that will raise the bar. Earnings are often revised higher in the period following a recession, so when combined with tailwinds such as multiple vaccines and additional fiscal stimulus, the S&P 500 will likely reach 4,025 by year end.

5. Info tech: Hitting the bullseye of our sector target

Archery incorporates both accuracy and precision, the same qualities we aim to possess as we determine our preferred sectors. Information technology has been the top-performing sector for three of the last four years, and we believe the rollout of 5G and the manner in which the pandemic altered the way companies conduct business will be additional arrows in the sector’s quiver. Given the tech-based adaptations in other industries, we believe investors can still score points with the healthcare, consumer discretionary, communication services and industrials sectors.

6. Wave of socially responsible investment not about to break

The sport of surfing began prior to 1770, but it will make its Olympic debut this year. Similarly, the principals of environmental, social, and corporate governance (ESG) investing have been practiced for decades, but between the Biden administration and the lingering impacts of the COVID-19 pandemic, the ESG wave is expected to grow.

7. Exposure abroad will be a balancing act

The uneven bars are one of the four events for female gymnasts, but they are also prevalent in our equity allocation preferences, as our bias toward U.S. equities remains intact. The broad-based global economic recovery would typically lead us to be more flexible with international exposure, but the sector allocation in Europe has garnered the region a few deductions. However, our preferred sectors, along with expectations for a weakening dollar and attractive valuations, present a favorable outlook for emerging market equities.

8. U.S. dollar will not have the inside track

The global economy’s recovery, ongoing aggressive fiscal and monetary policy action, a growing budget deficit, and – more likely than not – easing trading restrictions with China and our allies will all serve as hurdles in the dollar’s path, preventing it from moving higher. Ultimately, the weakening of the dollar may pass the baton to emerging market equities, emerging market bonds, commodities and U.S. multinational companies.

9. Oil demand to catch the crosswind of economic activity

2020 was anything but smooth sailing for the oil industry, as the Saudi-Russia oil price war and virus-induced lockdowns weighed heavily on oil prices. In 2021, a sustainable return to normality is expected to cause the best rebound in global oil demand since 1973. The gradual rise in oil prices (WTI Crude $60 per barrel year-end target) should put wind in the sails of the industry’s lagging recovery, but with the environment a top campaign issue for president-elect Biden, a renewable energy storm is on the horizon.

10. Keeping asset allocation parameters on the fairway

We expect overall market volatility to be more palatable in the year ahead, driven by the gradual reopening of the economy, more stable monetary policy and less political risk. But just because volatility won’t be on par with that of 2020 does not make adherence to asset allocation parameters any less important. With pullbacks still a natural occurrence for the equity market, it is critical that investors have a strategy in place for when the times get rough so that emotionally-driven investment decisions don’t lead portfolios into hazards.

All expressions of opinion reflect the judgment of the author and are subject to change. Past performance may not be indicative of future results. There is no assurance any of the trends mentioned will continue or forecasts will occur.

Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website’s users and/or members. Raymond James does not provide tax or legal services. Please discuss these matters with the appropriate professional.

Start the New Year With an Organized Outlook

Start the New Year With an Organized Outlook

Get organized this winter season by updating your financial plan and preparing for tax season.

As we start a new year, schedule some time to check in on your accounts, organize tax documents and review your health spending.

Winter 2021 market closures

Feb. 15: Presidents Day

Things to do

Organize for tax time: By early February, you should have tax forms in hand. Make sure to organize them, as well as any receipts if you itemize. To ensure all is in order, talk to your advisor about coordinating with your tax professional.

Brush up on benefits: Research your company’s open enrollment schedule and decide if you need to make changes.

Study your health spending: If you participate in a flexible spending account (FSA) or health savings account (HSA), review contribution levels to take full advantage – withoutexceeding limits, which are adjusted regularly for inflation. If you have an FSA, use available funds before your plan’s use- it-or-lose-it deadline.

Prepare to turn 65: This is the age you become eligible for Medicare; a 10% premium penalty applies for each year you go without Part B coverage beyond this birthday in most cases. You have seven months to enroll, starting from three months before your birth month. You can ask your advisor about healthcare planning resources.

Think through a work windfall: Plan how you want to use your year-end bonus before it hits your checking account. Consider paying down high-interest debt, shoring up your emergency fund or increasing your 401(k) contribution.

Set savings to automatic: If you haven’t automated retirement contributions, start now. It’s also a good time to reconfirm your employer match and increase your contributions to allow more time to generate tax-deferred gains.

Play by the IRA rules: Pre-tax contributions to IRAs can reduce taxable income, and you have until April 15 to contribute for the current tax year. You also have the option to contribute early in the year toward the next tax year – so tell your IRA custodian which year the contribution applies to.

Talk to your advisor to make sure you don't miss any important financial planning dates in the coming months.

Withdrawals from tax-deferred accounts may be subject to income taxes, and prior to age 59 1/2 a 10% federal penalty tax may apply. Investment products are: not deposits, not FDIC/NCUA insured, not insured by any government agency, not bank guaranteed, subject to risk and may lose value. Raymond James financial advisors do not render legal or tax advice. Please consult a qualified professional regarding legal or tax advice.

Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website’s users and/or members. Raymond James does not provide tax or legal services. Please discuss these matters with the appropriate professional.