Author Archive

Should You File Early for Social Security?

Should You File Early for Social Security?

Waiting until full retirement age makes sense for many investors – but not for every investor.

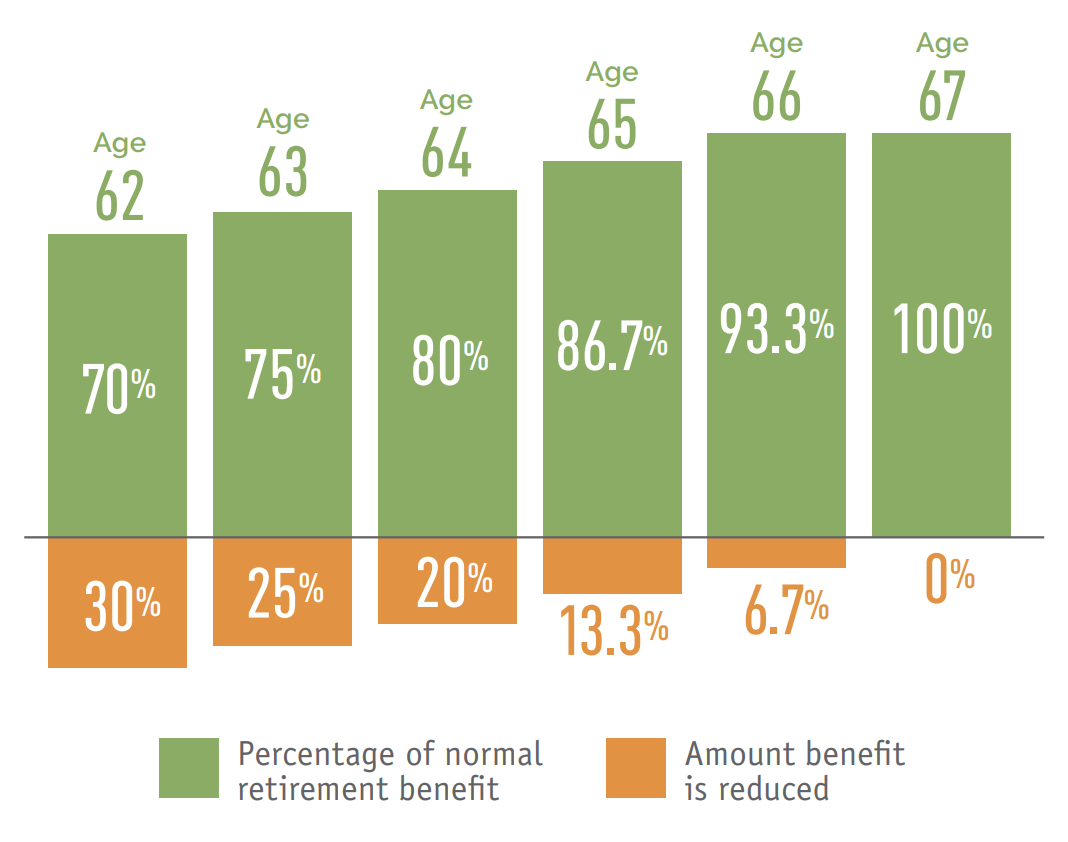

Conventional wisdom and a little bit of math tell us that waiting at least until full retirement age (between 66 and 67, depending on when you were born) will net a larger monthly payout than filing for Social Security as soon as you’re eligible at age 62. If you can wait even longer, you’ll get an 8% increase in your monthly benefits every year you delay between your full retirement age and age 70 – a potential 8% to 32% increase (a pretty impressive “rate of return” that’s hard to beat).

This assumes, of course, that you have good health as well as enough income and/or retirement savings that you can afford to wait.

But this approach may not fit every case. Depending on your financial standing, personal life expectancy and spousal situation, filing early can actually be advantageous. But make this decision carefully – remember, filing early yields a permanently reduced Social Security benefit.

Consider these three factors when deciding whether or not to file early:

Your cash needs

Sometimes, the best laid plans go awry. You may have to leave your job unexpectedly for health reasons – you may get burned out, or a business deal doesn’t go as well as hoped and you find yourself in debt. Perhaps you find yourself wanting – or needing – to spend more time with those you love. If you don’t have enough savings to retire sooner than planned, think about claiming Social Security benefits early.

Social Security offers a consistent source of income, so it can make for a great backup plan. But it’s important to really do the math and budget accordingly, since it’s unlikely to be a princely sum. Benefits are estimated to average $1,543 in January 2021, which would sum to about $18,516 per year. The maximum benefit at full retirement age for 2021 is $3,148, about $37,776 per year.

Some strong savers still like having extra income to fund more of their wants in early retirement, perhaps preferring to let dedicated retirement savings accounts continue to grow. The extra income can enhance the so-called “go-go” years, a period when we can expect to have the most time and energy when we first enter retirement.

Your health

If you live to the average life expectancy for someone your age, you’ll receive approximately the same amount over your lifetime whether you start collecting benefits sooner or later. But the math only works out if you live to your late 70s, the average American life expectancy. If you have a significant health event or have a family history of illness, filing early could be a smart option.

Your spouse

If you’re the lower-earning partner, your lifetime benefits will also be lower. Ask your advisor to calculate how to maximize your total household benefits. This plan could involve you filing earlier, and the higher-earning spouse delaying their more substantial benefits in order to get that 8% credit for each year between full retirement age and age 70. This strategy could maximize your benefits as a couple, and is also likely to secure higher survivor benefits for you when the time comes.

As with many financial decisions, the best Social Security claiming strategies need to account for your personal situation – your health, your savings, your marital status. Remember that you’re generally not eligible for Medicare until 65, so if you’re not covered by an employer, you may need to purchase your own health insurance coverage until Medicare kicks in.

It’s best to consult with your spouse and a knowledgeable financial advisor to help maximize this important source of recurring, inflation-adjusted and guaranteed income. Your advisor can help you run some calculations to maximize your household and lifetime Social Security benefits, which will help you and your spouse determine the most appropriate time to file.

Sources: Washington Post; Motley Fool; thebalance.com; cnbc.com; ssa.gov; Center for Retirement Research; investors.com

Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website’s users and/or members. Raymond James does not provide tax or legal services. Please discuss these matters with the appropriate professional.

10 Themes That Will Affect Your 2021 Investing

10 Themes That Will Affect Your 2021 Investing

The first-ever postponement of the Summer Olympics exemplifies the depths of disruption the pandemic has caused. However, the concept of the torch is associated with hope, light and strength, an excellent metaphor for the rescheduled start date – July 23, 2021 – likely coinciding with the sustainable reopening of many parts of the world.

As a salute to everyone that has done their part to make this happen – from scientists to frontline workers to the athletes themselves – and to set our sights on a more uplifting time period, we’ve chosen the Summer Games as the backdrop for our ten themes for 2021.

1. Global synchronized economic recovery: Rowing in the same direction

Nineteen of the twenty largest economies in the world experienced a contraction in growth in 2020, but we expect the entire crew to see positive growth in 2021. The coxswain of the recovery will be global central banks, led by the Federal Reserve (Fed), as its decisions to keep interest rates low and liquidity robust will ultimately dictate the power and pace of the global economic recovery.

2. U.S. economic recovery will take on a triathlon

The recovery will be defined by transitional periods with varying paces throughout the year. At the onset, worsening COVID trends and paused reopening processes will prove to be a challenge. Analogous to swimming, the first leg of the triathlon, the pace will be slower and the waters may be choppy. However, by the spring, economic growth will accelerate as the dissemination of vaccines push the pedal for more businesses to safely reopen. Toward the end of the year, we expect to reach a steadier stride, finishing at a slower but more sustainable pace.

3. Keeping portfolios en garde despite low yields

Fencing requires agility, coordination, balance, and timing – the same skill set global central banks displayed when adjusting interest rates in light of the COVID-19 pandemic. This year, acceleration in economic growth should thrust the yield back to the 1.50% level by year end, but low inflation, central bank buying, strong foreign demand and the growing economic sensitivity to higher yields will parry yields from returning to levels near 2% on a sustainable basis.

4. Earnings will do the heavy lifting

We remain positive on equities over the next 12 months, but it will be a powerful earnings rebound (20%+ earnings per share growth in 2021) that will raise the bar. Earnings are often revised higher in the period following a recession, so when combined with tailwinds such as multiple vaccines and additional fiscal stimulus, the S&P 500 will likely reach 4,025 by year end.

5. Info tech: Hitting the bullseye of our sector target

Archery incorporates both accuracy and precision, the same qualities we aim to possess as we determine our preferred sectors. Information technology has been the top-performing sector for three of the last four years, and we believe the rollout of 5G and the manner in which the pandemic altered the way companies conduct business will be additional arrows in the sector’s quiver. Given the tech-based adaptations in other industries, we believe investors can still score points with the healthcare, consumer discretionary, communication services and industrials sectors.

6. Wave of socially responsible investment not about to break

The sport of surfing began prior to 1770, but it will make its Olympic debut this year. Similarly, the principals of environmental, social, and corporate governance (ESG) investing have been practiced for decades, but between the Biden administration and the lingering impacts of the COVID-19 pandemic, the ESG wave is expected to grow.

7. Exposure abroad will be a balancing act

The uneven bars are one of the four events for female gymnasts, but they are also prevalent in our equity allocation preferences, as our bias toward U.S. equities remains intact. The broad-based global economic recovery would typically lead us to be more flexible with international exposure, but the sector allocation in Europe has garnered the region a few deductions. However, our preferred sectors, along with expectations for a weakening dollar and attractive valuations, present a favorable outlook for emerging market equities.

8. U.S. dollar will not have the inside track

The global economy’s recovery, ongoing aggressive fiscal and monetary policy action, a growing budget deficit, and – more likely than not – easing trading restrictions with China and our allies will all serve as hurdles in the dollar’s path, preventing it from moving higher. Ultimately, the weakening of the dollar may pass the baton to emerging market equities, emerging market bonds, commodities and U.S. multinational companies.

9. Oil demand to catch the crosswind of economic activity

2020 was anything but smooth sailing for the oil industry, as the Saudi-Russia oil price war and virus-induced lockdowns weighed heavily on oil prices. In 2021, a sustainable return to normality is expected to cause the best rebound in global oil demand since 1973. The gradual rise in oil prices (WTI Crude $60 per barrel year-end target) should put wind in the sails of the industry’s lagging recovery, but with the environment a top campaign issue for president-elect Biden, a renewable energy storm is on the horizon.

10. Keeping asset allocation parameters on the fairway

We expect overall market volatility to be more palatable in the year ahead, driven by the gradual reopening of the economy, more stable monetary policy and less political risk. But just because volatility won’t be on par with that of 2020 does not make adherence to asset allocation parameters any less important. With pullbacks still a natural occurrence for the equity market, it is critical that investors have a strategy in place for when the times get rough so that emotionally-driven investment decisions don’t lead portfolios into hazards.

All expressions of opinion reflect the judgment of the author and are subject to change. Past performance may not be indicative of future results. There is no assurance any of the trends mentioned will continue or forecasts will occur.

Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website’s users and/or members. Raymond James does not provide tax or legal services. Please discuss these matters with the appropriate professional.

Start the New Year With an Organized Outlook

Start the New Year With an Organized Outlook

Get organized this winter season by updating your financial plan and preparing for tax season.

As we start a new year, schedule some time to check in on your accounts, organize tax documents and review your health spending.

Winter 2021 market closures

Feb. 15: Presidents Day

Things to do

Organize for tax time: By early February, you should have tax forms in hand. Make sure to organize them, as well as any receipts if you itemize. To ensure all is in order, talk to your advisor about coordinating with your tax professional.

Brush up on benefits: Research your company’s open enrollment schedule and decide if you need to make changes.

Study your health spending: If you participate in a flexible spending account (FSA) or health savings account (HSA), review contribution levels to take full advantage – withoutexceeding limits, which are adjusted regularly for inflation. If you have an FSA, use available funds before your plan’s use- it-or-lose-it deadline.

Prepare to turn 65: This is the age you become eligible for Medicare; a 10% premium penalty applies for each year you go without Part B coverage beyond this birthday in most cases. You have seven months to enroll, starting from three months before your birth month. You can ask your advisor about healthcare planning resources.

Think through a work windfall: Plan how you want to use your year-end bonus before it hits your checking account. Consider paying down high-interest debt, shoring up your emergency fund or increasing your 401(k) contribution.

Set savings to automatic: If you haven’t automated retirement contributions, start now. It’s also a good time to reconfirm your employer match and increase your contributions to allow more time to generate tax-deferred gains.

Play by the IRA rules: Pre-tax contributions to IRAs can reduce taxable income, and you have until April 15 to contribute for the current tax year. You also have the option to contribute early in the year toward the next tax year – so tell your IRA custodian which year the contribution applies to.

Talk to your advisor to make sure you don't miss any important financial planning dates in the coming months.

Withdrawals from tax-deferred accounts may be subject to income taxes, and prior to age 59 1/2 a 10% federal penalty tax may apply. Investment products are: not deposits, not FDIC/NCUA insured, not insured by any government agency, not bank guaranteed, subject to risk and may lose value. Raymond James financial advisors do not render legal or tax advice. Please consult a qualified professional regarding legal or tax advice.

Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website’s users and/or members. Raymond James does not provide tax or legal services. Please discuss these matters with the appropriate professional.

From the Desk of Dale Crossley and Evan Shear

From the Desk of Dale Crossley and Evan Shear

We hope that you and your loved ones are healthy as we’ve ushered in 2021. We were all eager to leave 2020 in the rearview mirror and look forward to a brighter 2021. Although the pandemic is still impacting us as much as ever, more Americans are getting vaccinated and that’s a positive way to start the year. However, despite the good news about vaccines, as we speak with clients, what we’re seeing on the news is accurate - vaccines are still in short supply. Between healthcare workers, frontline workers and the most vulnerable populations, there’s just not enough supply to go around and it may be early summer before everyone who wants a vaccine gets one. Of course, we’re all rooting for the vaccine production and administration process to speed up, most importantly to save lives, but also to fully restart the economy and begin to see a strong recovery.

Besides the urgency of people seeking vaccines, we’re having many discussions with clients concerned about the proposed tax changes in the new Biden administration and what they might mean for the markets and the economy at large. We definitely anticipate some tax changes with the Democrats holding the balance of power, initially through the budget reconciliation process and then perhaps in later bills. Among some of the proposed changes are several tax increases for those earning over $400,000 per year, lower thresholds for estate tax exemptions and an increase in the corporate tax rate to 28% from 21% (reversing the Tax Cuts and Jobs Act of 2017 decrease from 35% to 21%).

Although the markets generally prefer a balance of power in Washington, this is not the first time that one party has had control over the House, Senate and White House. As you may recall from our article and video, “The Truth About the Presidential Election and Your Portfolio,” historically, the markets have performed equally well under both Democrats and Republicans. Still, with all the chatter in the media, clients are understandably concerned about the market impact, particularly after last spring. We want to take this opportunity to stress that we carefully develop your financial plan for the long-term, fully expecting ups and downs in the market. The cornerstone of your plan is our use of Voyage, a proprietary scoring process that provides us with disciplined and unemotional “buy” and “sell” signals as the market changes. We use those signals to move client assets between stock, bond, sector, money market mutual funds and exchange-traded funds. Although it’s sometimes difficult to resist, knowing you have a plan in place with hopefully curtail the temptation to make emotional decisions.

We’re here to help you navigate any potential adjustments that need to be made to your financial plan or estate plan due to tax changes. We’re also here as the markets continue to fluctuate from many factors - it’s what we expect and prepare for in our planning. Please don’t hesitate to reach out with any questions or concerns.

We look forward to a better 2021 for all!

Evan Shear Dale Crossley, JD

CERTIFIED FINANCIAL PLANNERTM Financial Planner

Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website’s users and/or members. Raymond James does not provide tax or legal services. Please discuss these matters with the appropriate professional.

There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. All opinions are as of this date and are subject to change without notice. Past performance is not a guarantee of future results.

From the Desk of Dale Crossley and Evan Shear

From the Desk of Dale Crossley and Evan Shear

As we approach Thanksgiving, we’re hoping that you and your loved ones can find a safe way to celebrate – whether a smaller than usual gathering or via Zoom, it’s such a great day to think about what’s positive in your life and forget, even for a moment, about the negative of 2020. With the COVID-19 pandemic, rollercoaster-like markets and an unprecedented presidential election, 2020 will not soon be forgotten. Despite all that, we both feel that we have so much to be grateful for, particularly during these times. We speak for the entire team in saying that we’re extremely thankful for our clients. We truly appreciate you entrusting us with your financial well-being, particularly as we approached the uncertainty with the election cycle.

Leading up to, and now after the unprecedented presidential election, we’ve been completely inundated with news and headlines and not surprisingly, the election drew the highest percentage of registered voters since the presidential election in 1900. The polls predicted a blue wave, but as it stands today, Biden is President-elect, the Democrats maintain the House majority and the Republicans will most likely retain the Senate. However, much attention will be focused on runoff elections, particularly in Georgia. Recounts and potential legal challenges, in addition to runoff elections in January, could reshape what we know today, but probably not significantly.

Key Takeaways

Below are key takeaways related to economic policies that we expect to take shape in the new administration. These key takeaways are discussed in more detail by Larry Adam, CIO and Washington Policy Analyst, Ed Mills in Raymond James’ 2020 Election Policy Insights, a collection of videos and articles. (https://www.raymondjames.com/commentary-and-insights/washington-policy).

1. Watch for a new, probably smaller fiscal stimulus package, possibly by the end of the year and likely before December 11 when the federal spending agreement is set to expire.

2. Moving forward, the Fed monetary policy will likely remain largely the same, providing continued liquidity and low-interest rates.

3. Taxes will likely not increase if the Republicans maintain the majority in the Senate. Otherwise, a 10% decrease in corporate earnings is possible in 2021.

4. Look for improved trade relations, particularly with Europe, potentially resulting in increased earnings for large multinational U.S. companies.

The makeup of government in Washington, DC is important to your investments, but there are other essential components. The overall economy, earnings growth, the policy of the Fed and secular factors all play a part in the markets. These factors all have an effect on portfolio performance and we take them into consideration when constructing your portfolios. With that in mind, we hope you can forget about the headlines for just one day and enjoy some turkey and stuffing. We hope you and your loved ones have a very happy Thanksgiving!

Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website’s users and/or members. Raymond James does not provide tax or legal services. Please discuss these matters with the appropriate professional.

There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. All opinions are as of this date and are subject to change without notice. Past performance is not a guarantee of future results.