Author Archive

2020 Outlook

2020 Outlook: The Expansion Continues

What a year!

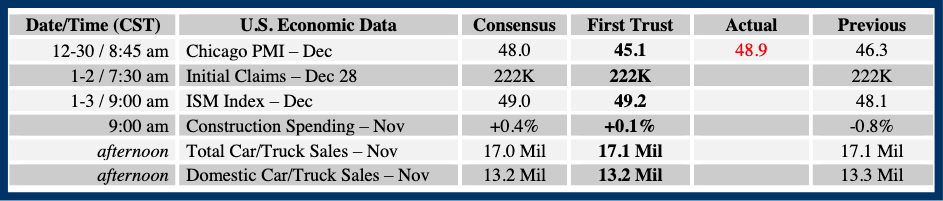

As of the close on Friday, the S&P 500 was up 29.2% in 2019. At the end of 2018, we forecasted the S&P would hit 3100this year. At the time, this was a very aggressive call. Then we doubled down at mid-year, lifting our forecast to 3250. At the end of last week we were only 0.3% away. Two weeks ago we made our case for 3650by the end of 2020. That may seem overly optimistic to some, but we’re already only 12.7% away. Stocks remain cheap at the current level of profits and are even more so given expected earnings growth.

Meanwhile, we look for the economy to continue to grow at a healthy clip, reaping the benefits of a lower tax rate on corporate profits and less regulation. The economic consensus is that the US economy will grow only 1.8% in 2020(on a Q4/Q4 basis), which would be the weakest growth since 2012. Instead, we’re forecasting growth in the 2.5 -3.0% range. In particular, look for both home building and business investment to contribute more to economic growth next year than they did in 2019, while growth in consumer purchasing power continues to boost spending.

As you’d expect, given that we’re projecting better economic growth,we’re also forecasting a stronger labor market. The consensus says the unemployment rate will tick up gradually to 3.6% by the end of 2020,versus 3.5% at present. Instead, we see the jobless rate falling to 3.3%, which would be the lowest since the early 1950s. Job growth should stay healthy with accelerating wages, particularly among low-income workers, leading to continued robust increases in the labor force (the number of people working or looking for work).

The consensus says payrolls should grow around 130,000 per month in 2020, tilted toward the first half of the year due to extra Census-related hiring. We’d take the “over,” with payrolls averaging more like 150,000 per month, and with the risks tilted more toward the upside.

On inflation, it looks like we’ll finish this year with the Consumer Price Index up about 2.2%,a small acceleration from the 1.9% increase in 2018. The consensus expects CPI inflation to fall back to 2.1% in 2020, but we project another acceleration, to 2.5%. Monetary policy is still loose and the M2 measure of the money supply has accelerated substantially this year. Look for further acceleration in inflation beyond 2020unless the Federal Reserve reverses course, an unlikely prospect given the unnecessary interest rate cuts this past year and the Fed’s reluctance to raise rates during a presidential election year.

One of the persistent flaws in the economic thinking of many analysts and investors is that an economic expansion has to come to an end because of old age alone. History contradicts this widespread claim. Research from the San Francisco Federal Reserve Bank back in 2016 shows that old economic expansions are no more likely than young expansions to die in the following year.

Our view is that entrepreneurship and public policy matter the most. The animal spirits of US entrepreneurs are alive and well; think about the innovations of the last decade and how they’ve changed the world and our daily lives. The US has gone from the world’s largest importer of petroleum products to being a net exporter. Cancer death rates are headed down substantially. The value of the technology we can hold in our hands easily dwarfs what even the best desktops could do a decade ago. Meanwhile, public policy is helping boost growth rather than holding it back. No tax hikes, trade conflicts likely on the wane, less regulation.

The current expansion won’t last forever. But we don’t see it ending anytime soon.

Source: First Trust Monday Morning Outlook, December 30, 2019. Consensus forecasts come from Bloomberg. This report was prepared by First Trust Advisors L. P., andreflects the current opinion of the authors.It is based upon sources and data believed to be accurate and reliable.Opinions and forward looking statements expressed are subject to change without notice.This information does not constitute a solicitation or an offer to buy or sell any security.

Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website’s users and/or members. Raymond James does not provide tax or legal services. Please discuss these matters with the appropriate professional.

What Everyone Should Know About the SECURE Act

What Everyone Should Know About the SECURE Act

(Setting Every Community Up for Retirement Enhancement).

We’ve outlined the top 10 changes brought about by the SECURE Act. Although there are several enhancements to retirement savings and distributions, the elimination of the Stretch IRA may have an impact on your heirs, so we recommend discussing potential ramifications with us during your next financial planning meeting.

- The Required Minimum Distribution (RMD) age is being moved from 70½ to 72, providing an extra 18 months to let retirement funds grow before being forced to tap into them.

- There are no age limits for investing in a traditional IRA. The limit was previously 70½, but now contributions can be made to a traditional IRA for those working into their 70s and beyond. There are currently no age-based restrictions on contributions to a Roth IRA.

- Part-time employees will have access to 401(k) plans, providing they have worked at least 500 hours per year for at least three consecutive years and who are 21 years old by the end of that three-year period.

- Penalty-free withdrawals are now available for the birth or adoption of a child. Each parent can withdrawal up to $5,000 from a retirement account without paying the usual 10% early-withdrawal penalty.

- The Act requires 401(k) plan administrators to provide an annual “lifetime income disclosure statement” to plan participants, so they can see how much money they could get each month if their 401(k) account balance was used to purchase an annuity. The SECURE Act will also make it easier for 401(k) plan sponsors to offer portable annuities and other “lifetime income” options to plan participants by taking away some of the associated legal risks.

- The Act will increase the 10% cap on “Qualified Automatic Contribution Arrangement” (QACA) automatic contributions up to 15%, after a worker’s first year of participation. This feature allows companies offering QACA’s to ultimately put more money into their workers’ retirement accounts easing them into higher contribution

- To help small businesses offer retirement plans, the Act will increase the tax credit to 50% of a small business’ retirement plan startup costs. The $500 per year tax credit limit will be increased to a maximum credit of $5,000.

- Amounts paid in the pursuit of extended study (such as the pursuit of graduate or post-doctoral study or research) will be treated as compensation for purposes of making IRA contributions, allowing students to begin saving for retirement sooner. Similarly, “difficulty of care” payments to foster care providers are also be considered compensation when it comes to 401(k) and IRA contribution requirements.

- Credit card access to 401(k) loans will be prohibited, no longer allowing employees to access plan loans by using credit or debit cards.

- The “Stretch” IRA for non-spouse beneficiaries who are greater than ten years younger than their spouse is being eliminated. Distributions over the life expectancy of a non-spouse beneficiary would only be allowed if the beneficiary is a minor, disabled, chronically ill, or not more than ten years younger than the deceased IRA owner. For minors, the exception would only apply until the child reaches the age of majority.

Source: adapted from https://www.kiplinger.com/slideshow/retirement/T047-S001-how-the-secure-act-will-impact-retirement-savings/index.html

Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website’s users and/or members. Raymond James does not provide tax or legal services. Please discuss these matters with the appropriate professional.

Cyber Security Protection

Cyber Security Protection

With geopolitical tensions rising, the headlines may have caught your attention so we want to review what Raymond James does to protect you by keeping your information secure.

Unfortunately, cyber threats aren’t new, and Raymond James has invested considerable financial resources and personnel to stay ahead of increasingly sophisticated threat actors. In fact, the firm has dedicated and certified information security analysts as well as advanced security infrastructure monitoring your accounts 24/7 to detect and defend against signs of tampering, unauthorized account activity and potential malicious intrusions.

And that’s just the start of the measures Raymond James has taken to protect our valued clients. Here’s a look at some of the precautions put in place behind the scenes to further protect your information.

- Proactive vulnerability testing of Raymond James networks and servers

- Encryption, secure virtual private networks, and the latest firewall and antivirus technology

- Vigilant email monitoring for regulatory and compliance purposes, as well as protection against phishing attempts and malware

- Quarterly technology reviews conducted by independent auditors

- Coordination with industry-wide organizations and law enforcement agencies devoted to sharing information about physical and cyber security to anticipate, mitigate and respond to emerging cyber threats

Their multi-layered defense, based on industry-leading security controls, is constantly evolving to stay ahead of the threat landscape. Good cyber security hygiene continues to remain a critical component of defense. Additional measures that you can take to help safeguard your information include:

- Keeping your technology (including mobile devices) and security software up to date

- Using public networks sparingly and with caution

- Implementing complex and unique passwords across all accounts

- Enabling multi-factor authentication wherever possible

- Practicing sensible data management, including regular data backups to protect against ransomware

Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website’s users and/or members. Raymond James does not provide tax or legal services. Please discuss these matters with the appropriate professional.

Laying the Groundwork for Tax Season

Laying the Groundwork for Tax Season

Tax Planning

Smart moves at the beginning of tax season can help get your financial house in order.

Contrary to popular belief, tax planning isn’t limited to the months between year-end and April 15. In fact, smart tax planning goes beyond deductions and credits and should be incorporated throughout the year. As Americans prepare to file their returns, let’s take a look at what we should be thinking about for tax season and beyond.

Get It Together, Now

The beginning of each new year is the time to get organized before filing your taxes. Make an appointment with your accountant and prepare by gathering all the relevant documentation.

Among other things, you’ll need:

- Year-end statements from financial accounts

- W-2s, 1098s and 1099s, K-1s (many can be found online)

- Last year’s tax returns

- Receipts for donations and business-related expenses

- Social Security numbers for your spouse and dependents

- Business identification number

- Tax ID number for daycares or schools, if filing for the carechild credit

Keep in mind that most 1099s should be mailed before the end of January, but they could be delayed or revised. You and your accountant will have to decide if you need to file an extension, a common occurrence these days.

Strategies for Any Season

If lowering your taxes is a priority, start a conversation with your financial and tax advisors about ways to save money come April 15. Consider these perennial options:

- Put pretax dollars to work. Flexible savings accounts – available during your employer’s open enrollment period – allow you to use pretax dollars to pay for qualified expenses. You can also use pretax retirement contributions to reduce your taxable income.

- Fill in the blanks. Work with your financial advisor to make sure all the cost-basis information is complete and accurate before calculating losses and gains for tax-loss harvesting purposes.

- Pursue tax-efficient investing. Investing should be focused on meeting your goals, not just on reducing taxes. But in some cases the two dovetail nicely. For example, interest* from municipal bonds is generally exempt from federal and state income tax (if you’re a resident of the state the bond is issued in). You could also sell underperforming stocks to offset realized gains.

For all taxpayers, it’s important to take a look at what tax strategies could benefit your specific situation without losing sight of your overall financial goals. Reviewing your investments in light of your goals, the tax environment, and the economic landscape can help you see where adjustments need to be made to position yourself for the upcoming year and beyond.

*Interest may be subject to the federal alternative minimum tax and state or local taxes.

Municipal bond investments may involve market risk if sold prior to maturity, credit risk and interest rate risk. There is no assurance that any investment strategy will be successful. Investing involves risk and investors may incur a profit or a loss. Please note, changes in tax laws or regulations may occur at any time and could substantially impact your situation. While familiar with the tax provisions of the issues presented herein, Raymond James Financial Advisors are not qualified to render advice on tax or legal matters. You should discuss any tax or legal matters with the appropriate professional.

As featured in the Raymond James Worthwhile magazine. Material prepared by Raymond James as a resource for its financial advisors.

Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website’s users and/or members. Raymond James does not provide tax or legal services. Please discuss these matters with the appropriate professional.

Zucchini Rolls

Zucchini Rolls

Ingredients

- 1 ball smoked scamorza Mozzarella

- 2 medium potatoes

- white bread

- 2 or 3 zucchini

- bread crumbs

- olive oil

- thyme, basil, parsley

- parmesan cheese

Directions

Filling: boil the potatoes, once softened peel them and add to the shredded smoked scamorza, white bread, grated parmesan cheese, chopped herbs, salt, and pepper. Season the mixture with a touch of olive oil.

Mix all together and let the dough rest in the fridge for about a half-hour.

Slice the zucchini into stripes then blanche them into salted boiling water for less than two minutes or simply grill them very lightly.

Once they cool down to be manageable, fill the stripes with the dough, and shape the rolls.

Sit the rolls into a butter greased baking dish, top the rolls with the mixture of bread crumbs, parmesan cheese, and chopped herbs and sprinkle them whit a touch of olive oil.

Put the baking dish into a preheated oven (200C/400F) until the top surface is golden brown (it should take approximately 15 minutes).

Let the rolls rest for a while, about 10 minutes, then ready to serve.

Recipe from La Cucina Sabina: https://www.lacucinasabina.com/recipe/zucchini-rolls/

Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website’s users and/or members. Raymond James does not provide tax or legal services. Please discuss these matters with the appropriate professional.