Author Archive

Elections and Real Estate: What History Tells Us

Election years are a time of uncertainty. Whether you are a home buyer or seller, your attention may be drawn away from real estate during the few crucial months leading up to the election. This may also cause you some concern as to whether the real estate market itself will be impacted by the election. How do elections impact real estate?

While there is some small change in the housing market during an election year, the good news is that you likely have nothing to worry about. Election years, as a whole, do not cause the housing market to break from larger trends. Home prices typically remain on the rise, and the occasional dip is not perceptibly election-related in any previous election year.

You can gain confidence in this fact by looking at historical data.

Election Years Do Not Impact the Economy

Overall, presidential elections do not have a perceptible impact on the economy. US Bank reports that there is no direct link between an election year and stock market outcomes. Gale Academic research has uncovered that the theory of a slower economic year during an election is not only a myth but that any economic indicators have been historically stronger during election years.

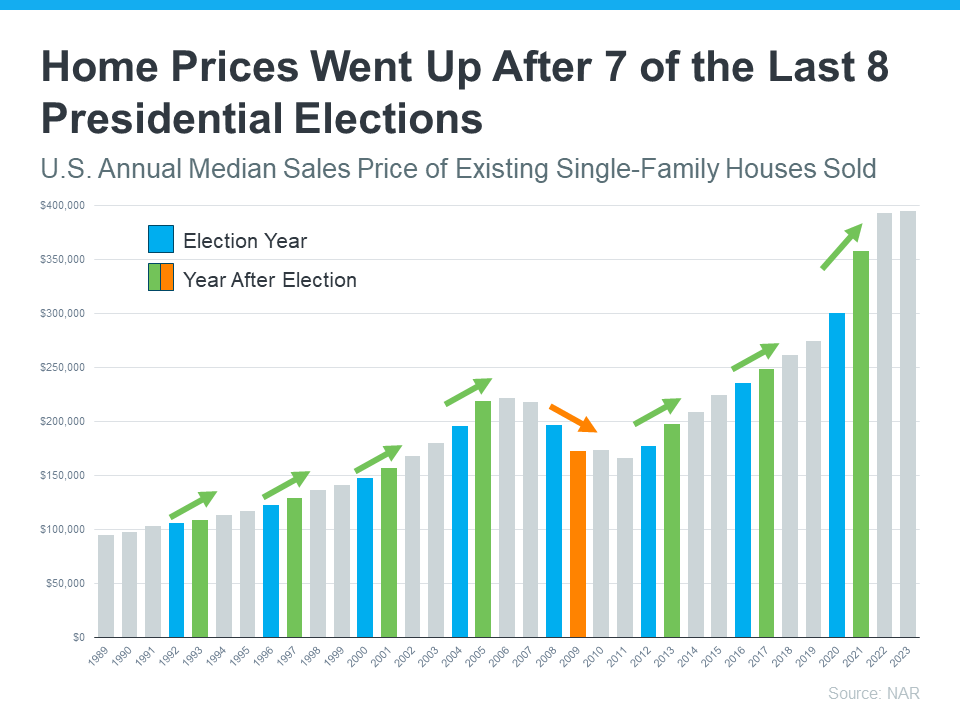

This is also true in the real estate industry. Data from the NAR shows that election years generally do not impact the home price trend perceptibly. Whether prices were following a multi-year trend of rising or falling, election years caused no significant change to the larger trend.

Home Price Trends

Real Estate Sales Remain Steady in Election Years

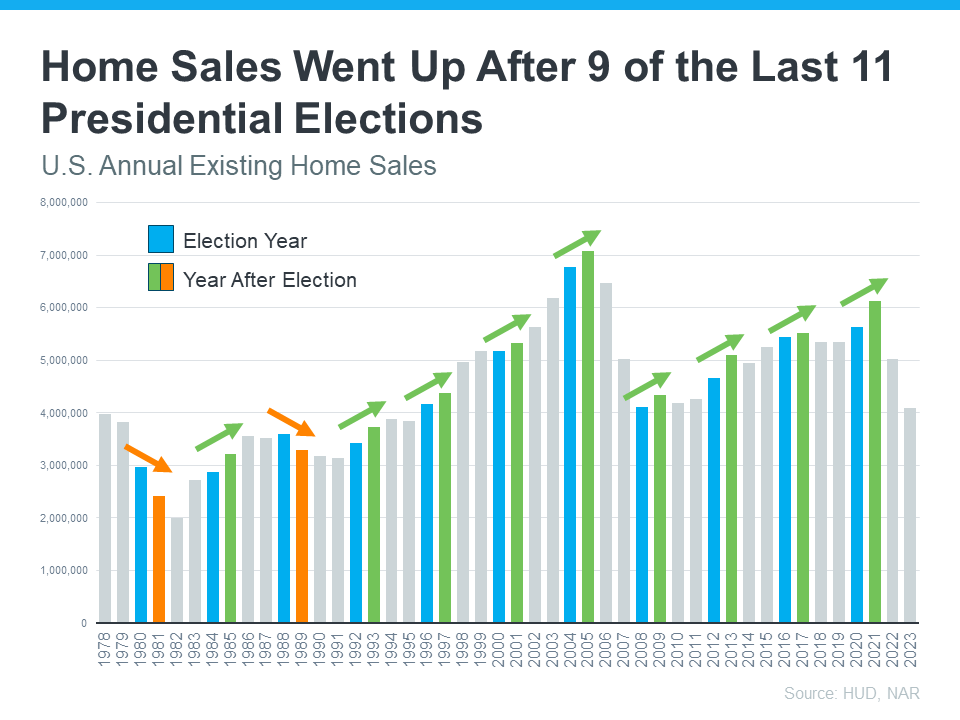

Just as home prices are unimpacted, so too is the rate of home sales. Home sellers can likely rest easy knowing that buyers are still making plans to buy in an election year. HUD NAR provides data that suggests election years maintain the home purchasing trend. However, home purchase rates may typically increase in the year after an election. This may be because the tension of the election is released. More people than usual feel confident making long-term decisions once they know who the president will be.

As you can see, the data shows that the number of home sales has gone up in the year after an election for the last 8 elections (since 1992) and has gone up for 9 of the last 11 elections since 1978.

The Dip: November Elections Impact on Real Estate

Historically a presidential election does have one small influence on the housing market: Home sales tend to slow down in November. Economist Ali Wolf reports that people may be cautious about making a big decision during the height of presidential election uncertainty. They will tend to put off on bidding or buying a house until they can be sure what to expect in terms of policy in the near future.

The good news is that the slowdown is not profound and doesn't last very long. Home sales typically pick back up to full speed by mid-December, and trends have resumed their normal course by April. Home sellers will see the full return of buyers, and buyers may see a new surge of available homes on the market as the election tension is resolved.

Mortgages Remain Unchanged

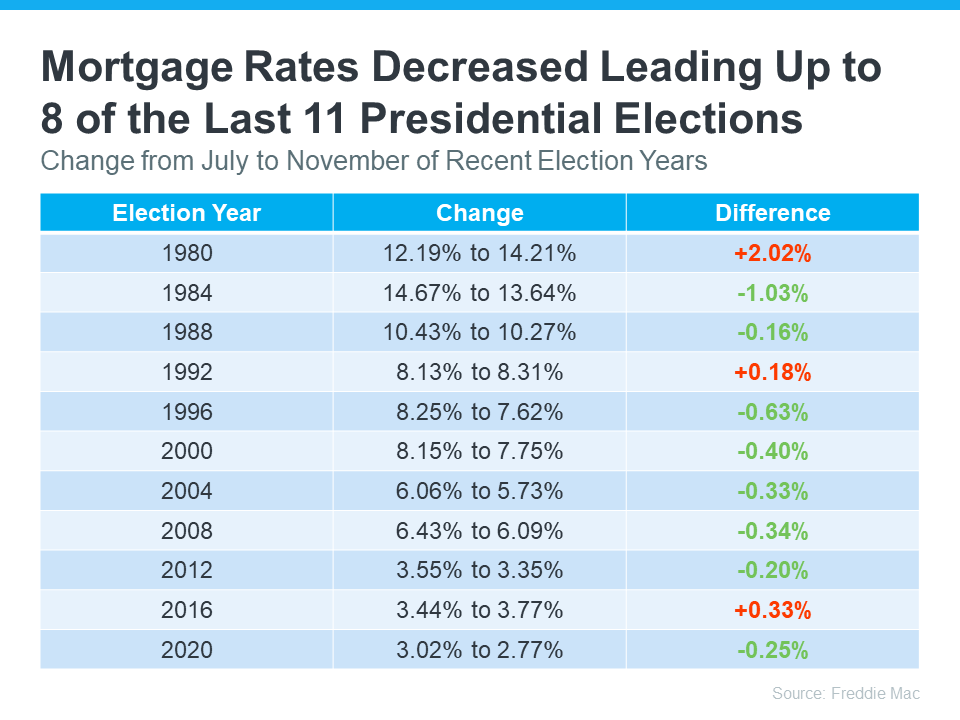

Mortgage rates also follow their own trends, and election years do not consistently impact mortgage rate increases or decreases. Freddie Mac reports that mortgage rates have decreased in the years leading up to 8 of the last 11 presidential elections, but these numbers follow existing trends as well.

2024-2025 Is a Safe Time to Buy or Sell a House

If you're looking to buy a home or are preparing a house to sell, don't worry about how elections impact real estate. Rest assured that the myth of the election year slow-down is just that: a myth. Both home prices and the rate of sales will likely remain steady, following existing trends. There may be a slight dip in activity in November, but not enough to cause a noticeable difference in the yearly totals.

Preparing to enter the housing market? CrossleyShear Wealth Management can help. Contact us today for your financial planning needs.

Any opinions are those of Dale Crossley and Evan Shear and not necessarily those of Raymond James. This information is intended to be educational and is not tailored to the investment needs of any specific investor. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete, it is not a statement of all available data necessary for making an investment decision, and it does not constitute a recommendation. Investing involves risk and you may incur a profit or loss regardless of strategy selected. Past performance is not indicative of future results. Ð'dLinks are being provided for informational purposes only. Raymond James is not affiliated with and does not endorse, authorize, or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website users and/or members.

Cyber Shield: Best Practices for Securing Your Personal Financial Data

In an era of innovative mobile software, convenient online banking, and endless cyber attacks your personal data is always at risk. Digital criminals continue to become more innovative in their methods to steal both individual and large archives of personal data to enact identity theft and financial fraud. The number of possible scams and hacking techniques only continues to grow.

Times are challenging for data security and financial safety. Now is a critical time to protect your personal data, and especially your financial information. The good news is that there are many security protocols and tools you can use to increase your personal data defense.

10 Ways to Protect Your Personal and Financial Data

1. Use Strong, Unique Passwords

Start by making your passwords longer, more complex, and more diverse. There are two methods for creating better passwords that are easy to remember.

Combination Words: eXtremely$afeP@ssw9rd

You can also use a password manager to keep all your passwords straight since it's best to use a unique password for every account and service.

2. Enable Two-Factor Authentication (2FA)

2FA or two-factor authentication sends you a text message or email to confirm logins. This is especially safe because most hackers don't have your phone or personal email. It also ensures you are notified if someone else tries to log in.

3. Be Wary of Phishing Scams

Phishing is when a hacker pretends to be someone familiar or a trusted brand in order to steal your information or get you to click an infected link. Phishing can target you personally or might set a general trap for people who use common brands. Always check if a sender or source is legitimate and trusted.

4. Monitor Your Accounts Regularly

Keep an eye on your financial accounts, especially your transaction history. Get to know your vendors and your own spending habits so that unknown charges are immediately obvious. Alert your financial provider to protect your account immediately if you notice suspicious activity.

5. Secure Your Devices

Keep your personal devices safe. Use lock screens, passcodes, and biometrics to ensure that all the personal data in your phone cannot be easily accessed if your phone is stolen. The same is true for any device where you are automatically logged into your apps and accounts.

6. Use Secure Networks

Hacked wifi networks are a common way for hackers to access personal computers and phones. Secure your home network with a firewall and router settings. Then, only use secured public networks when out in the world.

7. Be Cautious With Personal Data

Don't share your personal information in plain text. Even things that seem normal, like your name, address, and phone number, can be used to impersonate you and take over your accounts. Especially do not share any information about your finances, including the banks and services you use.

8. Educate Yourself and Stay Informed

Stay updated on the latest hacking and phishing tactics being used against companies and individuals. The cyber-threat landscape is constantly shifting as hackers develop new techniques to get around the latest defenses.

9. Implement Account Recovery Options

Account recovery options such as a connected phone number or backup account both make it more difficult for hackers to steal your accounts and make it easier for you to restore lost or stolen accounts.

10. Be Mindful of Data Breaches

Lastly, take data breaches seriously. Many apps and services will alert you if your passwords or accounts have been compromised. Take the necessary steps to re-secure your accounts, change your passwords, and protect your data or finances when these events occur. Most people experience some degree of data breach in their lifetime, often dozens of times in an adult career. Be wary and ready to respond.

Protect Your Personal Data and Your Financial Future

A single instance of identity theft can jeopardize your financial stability and future. Implementing practical cyber defense strategies is essential to protect your data, accounts, and finances. For comprehensive insights and personalized guidance on securing your financial future, trust CrossleyShear Wealth Management. Contact us for a consultation to ensure your financial well-being is safeguarded.

College Savings Plans: Help Ensure a Bright Future for Your Child’s Education

The Tax Cuts and Jobs Act of 2017 (TCJA) contained provisions affecting the estate tax. Along with several other provisions of the act, these changes are scheduled to sunset in 2025 unless Congress passes further legislation extending them or changing them.

Wealthier individuals and families need to understand what they need to consider moving forward to reduce the impact of these changes.

What Is the Estate Tax?

The estate tax is a tax levied on the estate of a deceased person when it is transferred. It is calculated using the value of the estate before distribution. This is sometimes called a "death tax." For 2024, the exemption amount is $13.61 million per individual or $27.22 million per married couple. This means that there is no tax levied on estates below this value. The tax is not meant to interfere with ordinary people's modest inheritances but rather to impact the wealthy.

The Impact of the TCJA

As a result of increasing house prices, estates are becoming more valuable. Part of the TCJA addressed this by increasing the exemption from $5.49 million per individual in 2017 to $13.61 million per individual in 2024 ($10.98 million in 2017 and $27.22 million for married couples in 2024), gradually increasing over the last 7 years indexed to inflation.

This allowed more wealth to be transferred before triggering the tax, primarily benefitting higher net-worth individuals with estates worth $6 to $13 million or so. It also benefitted people in areas with extremely high housing prices.

Sunsetting Provisions on Estate Tax Exemption

Most provisions of the TCJA, including this one, are set to expire on December 31, 2025. Congress could pass an act to extend this or to replace it with a different tax bill, but if no action is taken, the exemption amount will revert to the pre-TCJA level, adjusted for inflation.

An exact figure is hard to determine, but the best estimate is that it will be somewhere around $6 million for individuals. This change will dramatically impact individuals with a net worth around $6 million and married couples with around $12 million.

Potential Impacts

These individuals and families should brace for potential impacts, which include:

- Increased tax liability. Estates that were not subject to the tax will suddenly become vulnerable, increasing the tax burden on many families.

- Estate planning strategies. High-net-worth individuals and families may want to revisit and possibly revise strategies to consider the lower exemption. Some families that did not have a comprehensive strategy may need to implement one.

- Gift and Generation-Skipping Transfer Taxes. These limits are pegged to the estate tax limit to prevent people from using gifts to avoid the estate tax. You may need to change your strategy.

Estate Planning Considerations

While there is a non-zero chance that the TCJA will be extended, it's best to plan for the very real possibility that it will not. It is absolutely vital that you take the following steps:

- Review your existing estate plan. Ensure that it aligns with the lower exemption levels and that you take every step to minimize liability.

- Consider gifting strategies. While the gift tax limits are also going to go down, properly designed gifting strategies can still help reduce tax burdens, especially if done early enough.

- Consult a professional. It's time to sit down with your tax advisor, wealth advisor, and estate planning attorney to help come up with even better strategies to spare your family a huge tax blow in the event of your death.

Legislative Uncertainty

If nothing changes, then the estate tax provision will sunset. There is a fair amount of conflict about what Congress should do. In general, Republicans believe in extending the cuts to benefit Americans, but many Democrats are concerned about the deficit, including President Biden.

Whether anything will be done may, in part, depend on the results of the November election. For now, it is best to plan for the assumption that nothing will change.

The sunsetting of the TCJA's provisions regarding estate tax is significant for many high-net-worth individuals and families. You should be taking steps now to protect your family from an elevated tax burden. For professional advice to develop a comprehensive estate planning strategy, contact CrossleyShear today.

While we are familiar with the tax provisions of the issues presented herein, as Financial Advisors of RJFS, we are not qualified to render advice on tax or legal matters. You should discuss tax or legal matters with the appropriate professional.

The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete, it is not a statement of all available data necessary for making an investment decision, and it does not constitute a recommendation. Any opinions are those of CrossleyShear and not necessarily those of Raymond James.

The Sunsetting of the Increased Estate Tax Exemption in 2025: What You Need to Know

The Tax Cuts and Jobs Act of 2017 (TCJA) contained provisions affecting the estate tax. Along with several other provisions of the act, these changes are scheduled to sunset in 2025 unless Congress passes further legislation extending them or changing them.

Wealthier individuals and families need to understand what they need to consider moving forward to reduce the impact of these changes.

What Is the Estate Tax?

The estate tax is a tax levied on the estate of a deceased person when it is transferred. It is calculated using the value of the estate before distribution. This is sometimes called a "death tax." For 2024, the exemption amount is $13.61 million per individual or $27.22 million per married couple. This means that there is no tax levied on estates below this value. The tax is not meant to interfere with ordinary people's modest inheritances but rather to impact the wealthy.

The Impact of the TCJA

As a result of increasing house prices, estates are becoming more valuable. Part of the TCJA addressed this by increasing the exemption from $5.49 million per individual in 2017 to $13.61 million per individual in 2024 ($10.98 million in 2017 and $27.22 million for married couples in 2024), gradually increasing over the last 7 years indexed to inflation.

This allowed more wealth to be transferred before triggering the tax, primarily benefitting higher net-worth individuals with estates worth $6 to $13 million or so. It also benefitted people in areas with extremely high housing prices.

Sunsetting Provisions on Estate Tax Exemption

Most provisions of the TCJA, including this one, are set to expire on December 31, 2025. Congress could pass an act to extend this or to replace it with a different tax bill, but if no action is taken, the exemption amount will revert to the pre-TCJA level, adjusted for inflation.

An exact figure is hard to determine, but the best estimate is that it will be somewhere around $6 million for individuals. This change will dramatically impact individuals with a net worth around $6 million and married couples with around $12 million.

Potential Impacts

These individuals and families should brace for potential impacts, which include:

- Increased tax liability. Estates that were not subject to the tax will suddenly become vulnerable, increasing the tax burden on many families.

- Estate planning strategies. High-net-worth individuals and families may want to revisit and possibly revise strategies to consider the lower exemption. Some families that did not have a comprehensive strategy may need to implement one.

- Gift and Generation-Skipping Transfer Taxes. These limits are pegged to the estate tax limit to prevent people from using gifts to avoid the estate tax. You may need to change your strategy.

Estate Planning Considerations

While there is a non-zero chance that the TCJA will be extended, it's best to plan for the very real possibility that it will not. It is absolutely vital that you take the following steps:

- Review your existing estate plan. Ensure that it aligns with the lower exemption levels and that you take every step to minimize liability.

- Consider gifting strategies. While the gift tax limits are also going to go down, properly designed gifting strategies can still help reduce tax burdens, especially if done early enough.

- Consult a professional. It's time to sit down with your tax advisor, wealth advisor, and estate planning attorney to help come up with even better strategies to spare your family a huge tax blow in the event of your death.

Legislative Uncertainty

If nothing changes, then the estate tax provision will sunset. There is a fair amount of conflict about what Congress should do. In general, Republicans believe in extending the cuts to benefit Americans, but many Democrats are concerned about the deficit, including President Biden.

Whether anything will be done may, in part, depend on the results of the November election. For now, it is best to plan for the assumption that nothing will change.

The sunsetting of the TCJA's provisions regarding estate tax is significant for many high-net-worth individuals and families. You should be taking steps now to protect your family from an elevated tax burden. For professional advice to develop a comprehensive estate planning strategy, contact CrossleyShear today.

While we are familiar with the tax provisions of the issues presented herein, as Financial Advisors of RJFS, we are not qualified to render advice on tax or legal matters. You should discuss tax or legal matters with the appropriate professional.

The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete, it is not a statement of all available data necessary for making an investment decision, and it does not constitute a recommendation. Any opinions are those of CrossleyShear and not necessarily those of Raymond James.

Taming the “What-if Monster”: The Crucial Role of Portfolio Diversification

When it comes to investing, one monster looms over investors: the "what-if monster." This monster is all those thoughts that keep you up at night as you think about the worst-case scenarios and fear that if one thing goes wrong, your entire investment strategy could be at risk. Doubt is normal, but it isn't always helpful. The what-if monster can be debilitating and make it hard for investors to have confidence.

With investment portfolio diversification, however, any investor can transform their relationship with the what-if monster and feel prepared for the ups and downs of the market.

What is Diversification and Why is It Important?

Diversification simply means creating a mix of varied investments, ensuring that investors do not put all their eggs in one basket. That means making sure your asset mix includes stocks, bonds, and short-term investments and then aligning to your investment time frame, financial needs, as well as your comfort level with volatility. Working with a financial planner allows you to review and discuss different levels of risk and return potential and ensure you feel confident with your investment strategy. As your assets grow, periodic redistribution of your assets is essential to ensure your portfolio remains balanced and diversified.

- Spreads out and reduces risk

- Mitigates unsystematic risk (it doesn't help if the entire market collapses)

- Allows you to choose more investments

- Preserves your capital

- While it can sometimes result in lower returns, it comes with a significant reduction in risk.

How to Ensure Your Portfolio is Properly Diversified

It's best to seek the help of an expert to ensure you minimize your risk and maximize your return. Here are some things we can help with to let you build a resilient portfolio to support your long-term success:

1. Investment research. While you may get some enjoyment from doing this yourself, an expert can help you find opportunities you might not have thought of, spot red flags, and make the best decision. We can also help you find investments that fit your personal values.

2. Portfolio diversification strategies. Portfolio diversification strategies vary depending on your investment horizon and risk tolerance. We can help you pick the right strategy to support your short- and long-term needs. You should also diversify across industries and take into account disruption.

3. Monitoring and Rebalancing. No portfolio can sit there, untouched. Monitoring your portfolio and making changes to deal with world events, market changes, and exciting new opportunities can be almost a full-time job. We can help you keep an eye on your portfolio and make adjustments, rebalancing as needed. Also, if you find watching your stocks makes you anxious, don't worry, we can handle it for you.

4. Behavioral guidance. Some people chase shiny stocks. Others are so risk-averse they miss opportunities. We can help you learn to find a good middle path, developing a long- term financial plans built to withstand the inevitable ups and downs of the market.

5. Tax efficiency. Finally, we can help you manage your portfolio in ways that minimize your tax burden. We can help you decide how much to put into long-term funds for the future, how much to keep liquid, and when the best time is to withdraw money.

Quieting the "What-if Monster"

A diversified investment portfolio helps focus on your time, energy, and resources and what you can control and let go of what you cannot. Reach out and schedule an appointment with us. The what-if monster lives in every investor, but you can reduce the chatter of this monster by having us create a diversified portfolio, thoughtfully put together to weather market fluctuations.

Every investor's situation is unique and you should consider your investment goals, risk tolerance and time horizon before making any investment. Prior to making an investment decision, please consult with your financial advisor about your individual situation. You should discuss any tax or legal matters with the appropriate professional.

The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete, it is not a statement of all available data necessary for making an investment decision, and it does not constitute a recommendation. Any opinions are those of Evan Shear, CFP® and Dale Crossley, JD and not necessarily those of Raymond James.